Artikel ini adalah satu taklimat ringkas tentang situasi perdagangan saham di China. Ia meneroka faktor-faktor yang menyebabkan kemerosotan saham China, menilai impak perubahan dasar yang pantas, dan mempertimbangkan risiko dan potensi masa depan pelaburan di pasaran saham China.

Situasi pasaran saham China

Pada awal 2021, harga saham China mula merosot. Hal ini semakin meruncing sepanjang tahun lalu disebabkan oleh beberapa faktor. Antaranya adalah tindakan pengawalseliaan yang keras secara meluas terhadap sektor teknologi dan pendidikan, yang telah melenyapkan lebih $1 trilion daripada nilai syarikat-syarikat teknologi utama sejak November 2020.

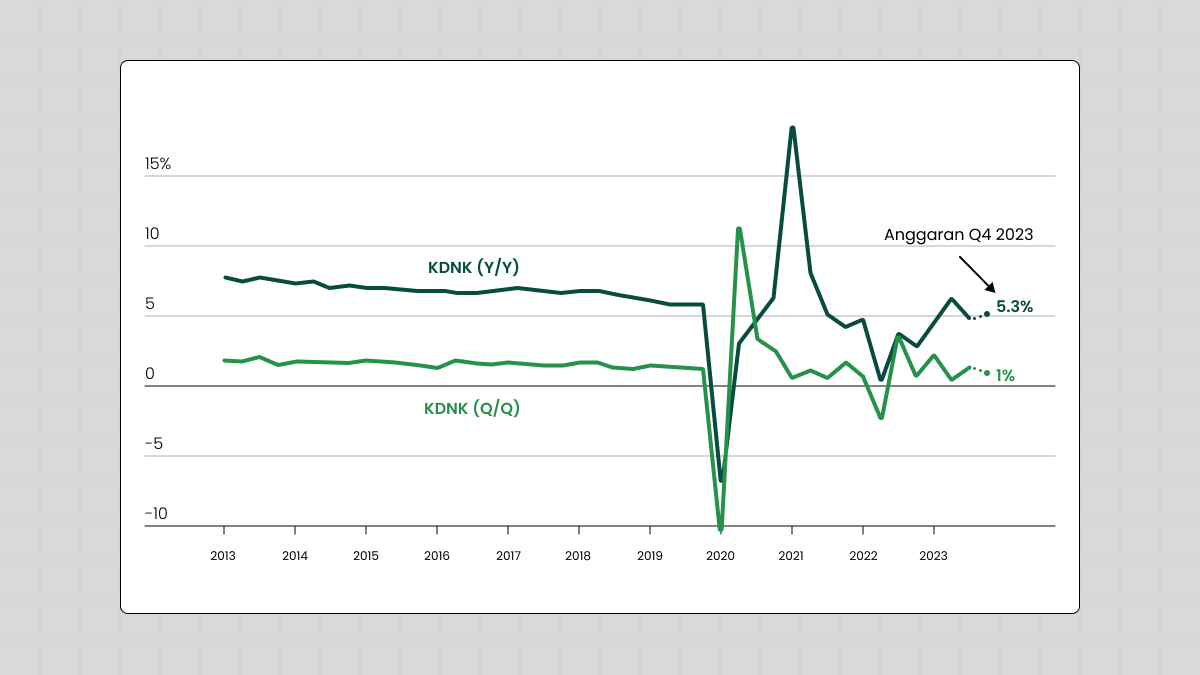

Keadaan ini diburukkan lagi dengan dasar sifar kupon China yang ketat, yang mempunyai impak yang ketara terhadap keyakinan bisnes, permintaan domestik, dan produktiviti ekonomi keseluruhan. Walaupun selepas perintah lockdown ditarik balik pada awal 2023, pemulihan ekonomi berlaku secara perlahan dan tidak menentu, memberi kesan kepada keuntungan korporat dan prestasi saham merentasi banyak sektor.

Di samping itu, ketegangan geopolitik telah meningkat, terutamanya dengan Amerika Syarikat, yang membawa kepada langkah-langkah pelaburan yang restriktif dan menjadikan landskap ekonomi semakin tegang. Pada tahun 2024, selepas Tahun Baru Cina, langkah-langkah pengawalseliaan baru diumumkan di bawah kepimpinan ketua CSRC yang baru, Wu Qing, untuk mengetatkan pengawasan amalan-amalan dalam pasaran. Namun begitu, biar pun dengan semua usaha ini keyakinan pelabur tetap rendah kesan daripada penguatkuasaan yang berterusan terhadap manipulasi pasaran dan aktiviti haram yang lain.

Sepanjang tempoh ini, Shanghai Composite dan indeks utama lain jatuh mendadak, dan syarikat-syarikat besar seperti Great Wall Motor dan Poly Real Estate mengalami penurunan harga saham yang dramatik. Sebagai contoh, menjelang Januari 2024, saham Great Wall Motor telah jatuh 27.86%, dan saham Poly Real Estate telah jatuh 43.81%.

Kerajaan telah cuba campur tangan dengan mencadangkan suntikan kewangan yang besar, seperti RMB 2 trilion yang dilaporkan dibawa masuk dari akaun luar pesisir perusahaan milik negara, untuk menstabilkan pasaran. Walau bagaimanapun, langkah-langkah ini masih belum dapat memulihkan keyakinan pelabur domestik dan antarabangsa sepenuhnya.

Minggu yang sukar untuk saham China

Dalam satu plot twist yang tidak dijangka, pasaran saham China menunjukkan tanda-tanda perubahan yang pesat dalam masa seminggu, dipengaruhi terutamanya oleh campur tangan kerajaan dan sentimen pasaran. Perubahan pesat ini diserlahkan oleh satu pengumuman besar dalam mesyuarat kerajaan "Two Sessions" pada awal Mac 2024, yang mencetuskan harapan dan keraguan di kalangan pelabur dan penganalisis.

Kerajaan China mengumumkan satu siri langkah rangsangan makroekonomi untuk menstabilkan pasaran dan meningkatkan keyakinan pelabur. Antara yang utama ialah pakej bailout USD 319 bilion yang dicadangkan untuk menyokong pasaran saham A yang merosot. Pakej ini adalah untuk memasukkan dana dari akaun luar pesisir perusahaan milik negara China dan dana tambahan dari syarikat "national team" seperti China Securities Finance Corp dan Central Huijin Investment. Walaupun dengan saiz campur tangan yang dicadangkan, tindak balas pasaran bercampur-campur, mencerminkan kebimbangan yang berlarutan tentang keberkesanan dan penggunaan sebenar dana ini.

Pada mulanya, pasaran bertindak balas secara positif terhadap pengumuman tersebut, dengan indeks utama seperti Indeks Hang Seng dan CSI 300 pulih sedikit daripada paras terendahnya. Walau bagaimanapun, rali ini tidak kekal lama kerana isu-isu ekonomi yang mendasarinya, termasuk pemulihan pasca-COVID yang perlahan dan masalah hartanah yang berterusan, terus memberikan tekanan terhadap pasaran.

Apa kata penganalisis

Penganalisis tetap berhati-hati, menegaskan bahawa walaupun niat kerajaan untuk menstabilkan pasaran adalah jelas, kesan sebenar langkah-langkah ini akan bergantung pada kejayaan pelaksanaan dan keupayaan mereka untuk menangani isu struktur yang lebih mendalam dalam ekonomi China. Terdapat konsensus bahawa walaupun usaha ini boleh memberikan kelegaan jangka pendek, kestabilan jangka panjang masih jauh daripada terjamin.

Organisasi kewangan utama seperti Goldman Sachs dan UBS meramalkan pemulihan dalam pasaran saham China. Goldman Sachs menjangkakan indeks utama seperti MSCI China dan CSI 300 akan meningkat, menyatakan bahawa jangkaan pertumbuhan pendapatan dan kenaikan yang sederhana sebagai faktor utama. Mereka melihat potensi pelonggaran dasar, rangsangan fiskal dan pelonggaran peraturan industri sebagai faktor kritikal yang boleh menyumbang kepada penstabilan dan pertumbuhan pasaran.

Saham China hari ini: sokongan dan ancaman

Faktor-faktor yang menyokong

Walaupun bergelora, beberapa faktor sokongan dapat memberikan kestabilan dan potensi pertumbuhan untuk pasaran saham China:

Sokongan dasar kerajaan

Fundamental ekonomi

Kemajuan dan inovasi teknologi

Faktor risiko

Walaupun faktor-faktor sokongan boleh membantu menstabilkan pasaran saham nasional negara itu, beberapa faktor risiko masih boleh menjejaskan statistik saham China dan menimbulkan cabaran yang signifikan bagi para pelabur.

Ancaman yang wujud terhadap harga saham China termasuklah:

Kelembapan ekonomi

Ketegangan geopolitik

Persekitaran regulatori

Sentimen pasaran domestik

Keadaan ekonomi global

Rangkuman

Kejatuhan saham China ke paras terendah dalam satu dekad menandakan satu titik perubahan, mencerminkan ketidaktentuan ekonomi dan kawalan selia yang mendalam. Walau bagaimanapun, usaha kerajaan China untuk menstabilkan pasaran dan meningkatkan keyakinan pelabur, serta potensi pertumbuhan jangka panjang China yang sukar untuk dinafikan, menunjukkan kemungkinan pemulihan.

Pada zaman yang bergolak ini, masa depan statistik saham China bergantung pada keseimbangan, dipengaruhi oleh dasar ekonomi domestik dan hubungan antarabangsa. Walaupun risiko kekal tinggi disebabkan oleh ketegangan geopolitik yang berterusan dan ketidaktentuan pasaran domestik, kekuatan domestik ekonomi China dan dasar kerajaan yang strategik boleh membuka jalan untuk menghidupkan semula minat pelabur dan mengembalikan kestabilan pasaran.

Soalan Lazim

Bagaimana saya boleh membeli saham China?

Untuk membeli saham China, anda boleh membuka akaun perbrokeran dengan firma-firma yang menawarkan akses kepada pasaran saham China. Memastikan pematuhan peraturan bagi pelabur asing. Pertimbangkan untuk menggunakan platform pembrokeran antarabangsa atau broker tempatan di China. Kaji dan pilih saham tertentu, kemudian buat pesanan beli melalui broker pilihan anda. Berhati-hati dengan kadar pertukaran matawang dan kemungkinan adanya batasan kawal selia. Sentiasa jalankan penyelidikan yang menyeluruh dan pertimbangkan untuk berunding dengan penasihat kewangan sebelum melabur.

Cara melabur dalam pasaran saham China

Untuk melabur dalam pasaran saham China, buka akaun perbrokeran antarabangsa, pastikan ia menawarkan akses kepada saham China. Lengkapkan sebarang dokumentasi yang diperlukan dan patuhi syarat kawal selia. Kaji dan pilih saham yang anda ingin beli, kemudian buat pesanan anda melalui platform perbrokeran. Berhati-hati dengan kadar pertukaran matawang dan perbezaan peraturan, dan pertimbangkan untuk berunding dengan penasihat kewangan sebelum melabur.

Adakah pasaran saham China dibuka sekarang?

Pasaran saham China dibuka untuk trading. Ia beroperasi pada hari bekerja dari Isnin hingga Jumaat, dengan waktu perdagangan dari 9:30 pagi hingga 3:00 petang waktu tempatan. Walau bagaimanapun, ia ditutup pada cuti umum China.