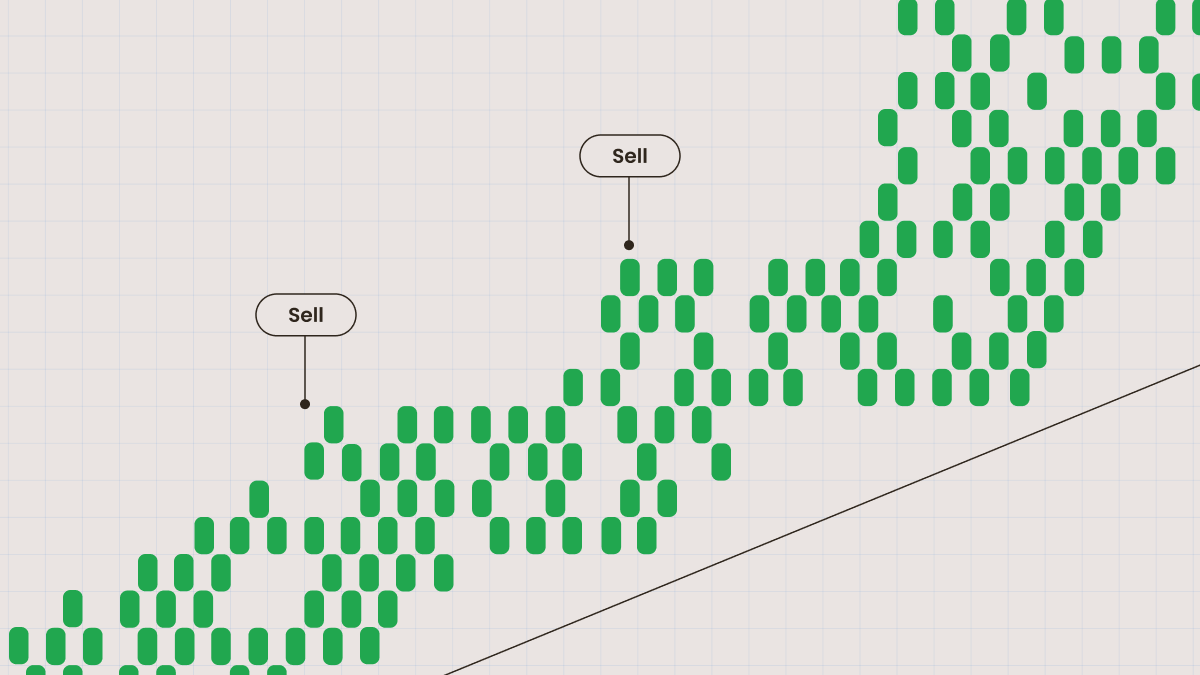

Strategi trading melawan trend adalah percubaan untuk membuat keuntungan kecil dengan membuka urusniaga melawan trend utama. Trading melawan trend adalah satu bentuk perdagangan swing yang menganggap bahawa trend pasaran semasa akan mengalami penyongsangan atau pengunduran dan kemudian cuba untuk membuat keuntungan daripada pengunduran apabila trend pendasar bersambung kembali. Strategi ini adalah strategi jangka sederhana, di mana posisi dikekalkan selama beberapa hari atau beberapa minggu.

Sesetengah trader yang menggunakan strategi ini untuk mengaut keuntungan menggunakan pengunduran (pullback) sambil mengekalkan posisi utama mereka dalam arah trend tersebut. Strategi-strategi melawan trend menggunakan indikator-indikator momentum, aras sokongan dan rintangan serta pola-pola candlestick untuk mengenal pasti lokasi yang berpotensi dijadikan poin masuk. Walau bagaimanapun, trader yang menggunakan kaedah ini perlu bersedia untuk menyambung kembali trend semasa pada bila-bila masa tanpa amaran. Justeru itu, apabila anda trade dengan strategi ini, teknik pengurusan risiko yang betul seperti pesanan renti rugi dan saiz posisi minimum harus digunakan untuk mengehadkan kerugian.

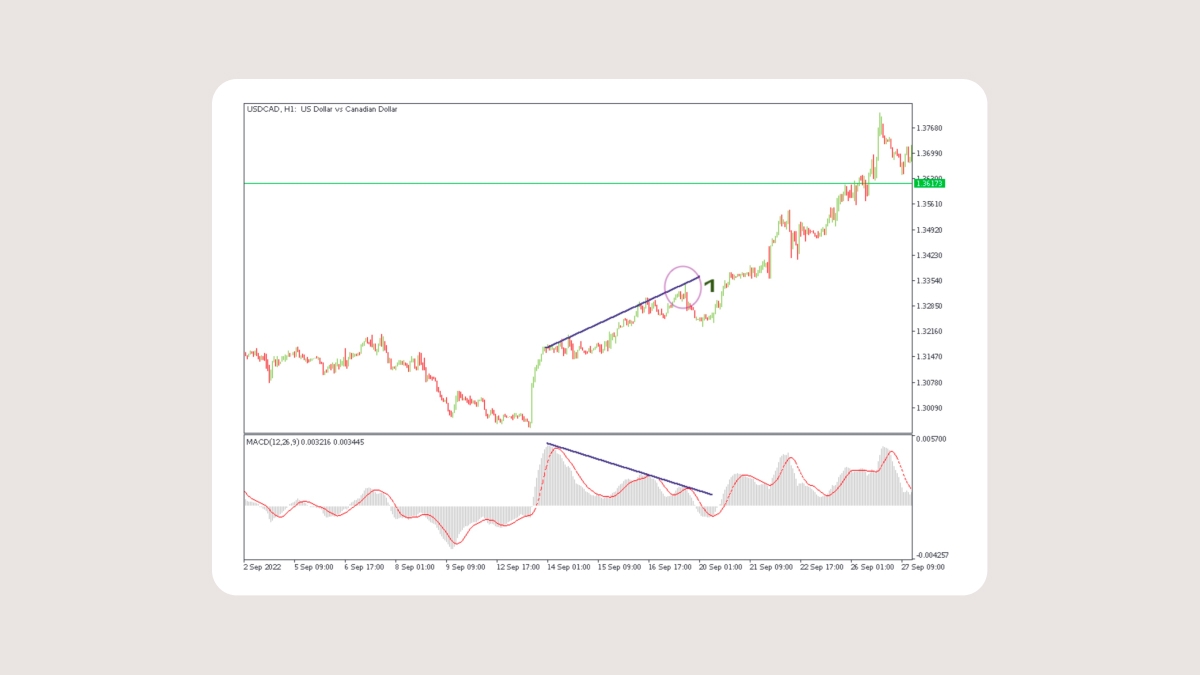

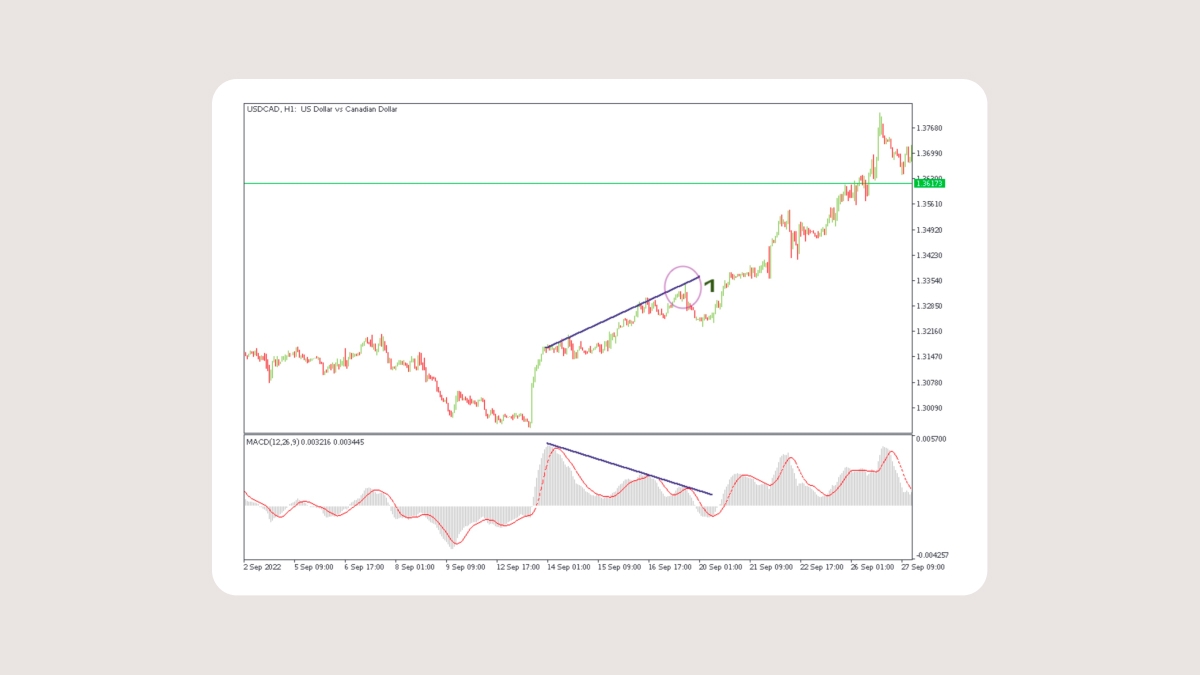

Para trader yang menggunakan pendekatan ini mengambil petunjuk daripada pola candlestick penyongsangan (pin bar, evening star, morning star, dsb.). Mereka juga menggunakan osilator-osilator seperti MACD atau RSI untuk melihat sama ada pasaran telah terlebih beli/terlebih jual dan sama ada terdapat capahan (divergence) antara harga dan indikator. Jika tanda-tanda ini ada, trader akan membuka pesanan yang berlawanan arah dengan trend sebelumnya.

Trader boleh memutuskan untuk menjual di Titik 1 apabila harga membentuk candlestick dengan bayang yang panjang (petanda yang negatif) dan indikator MACD tidak mengesahkan harga tertinggi.

Ambilan Untung (Take Profit)

Adalah lebih sukar untuk mencari tempat untuk memuktamadkan keuntungan apabila anda trade melawan trend. Cabarannya ialah untuk menahan diri daripada terlalu tamak. Ingatlah bahawa anda sedang bertaruh melawan pasaran. Sesetengah trend boleh bertukar menjadi pasaran mendatar yang mengehadkan keuntungan bagi posisi melawan trend. Trend asal juga boleh bersambung semula dengan pantas dan tidak membiarkan harga membetul terlalu banyak. Berhati-hati dan kawal risiko anda.

Renti Rugi (Stop Loss)

Lokasi untuk pesanan Renti Rugi dalam urusniaga sedemikian adalah jelas dan nyata. Para trader meletakkan Renti Rugi mereka di belakang titik ektstrim harga iaitu lokasi di mana pembetulan bermula. Renti Rugi mungkin lebih kecil daripada yang anda akan gunakan jika anda trade dengan trend utama.

Pembesaran Posisi (Scaling in)

Ia bukan idea yang baik untuk mengusik saiz posisi anda apabila anda sedang trading melawan trend. Tempoh masa urusniaga tersebut mungkin sangat pendek, oleh itu anda berisiko untuk berada dalam situasi yang tidak selesa jika anda cuba membesarkan saiz urusniaga. Dan jangan besarkan posisi yang rugi kerana ia boleh menyebabkan kerugian yang lebih besar.

Dalam video baharu kami, kami akan membincangkan tentang trading mengikut trend dan trading melawan trend dengan lebih tepat.

Kesimpulan