History of ETFs

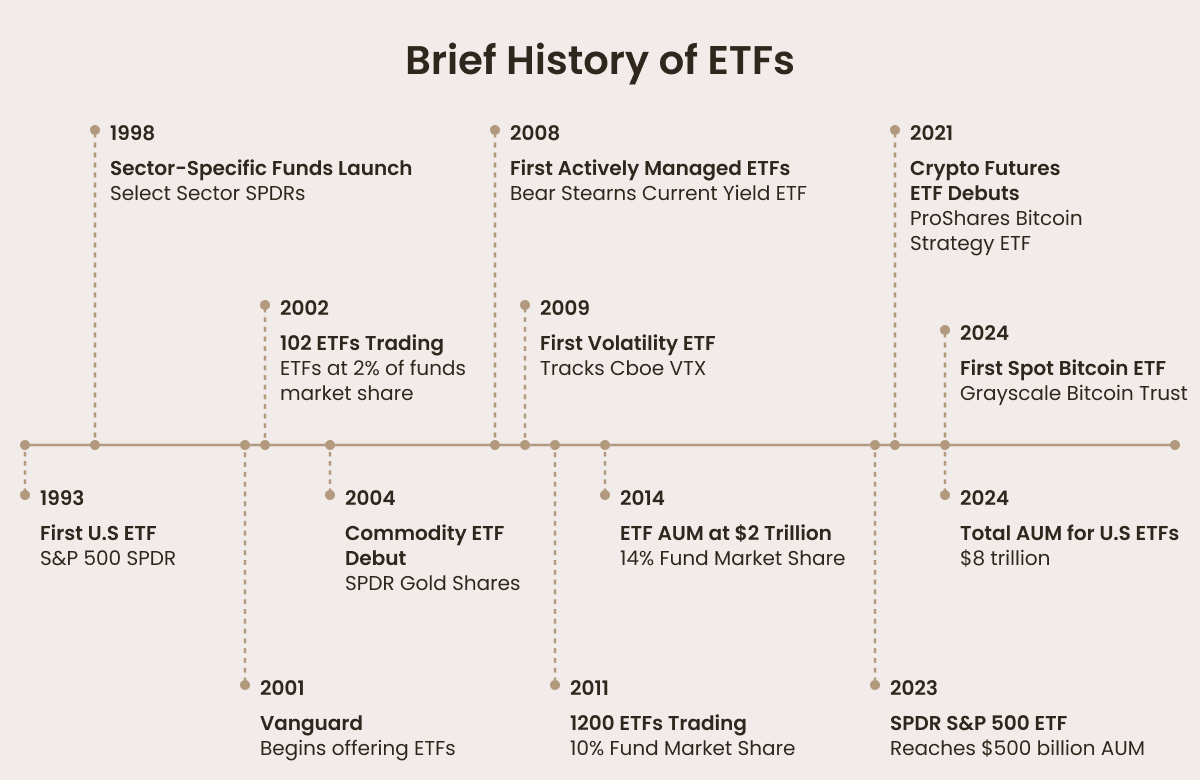

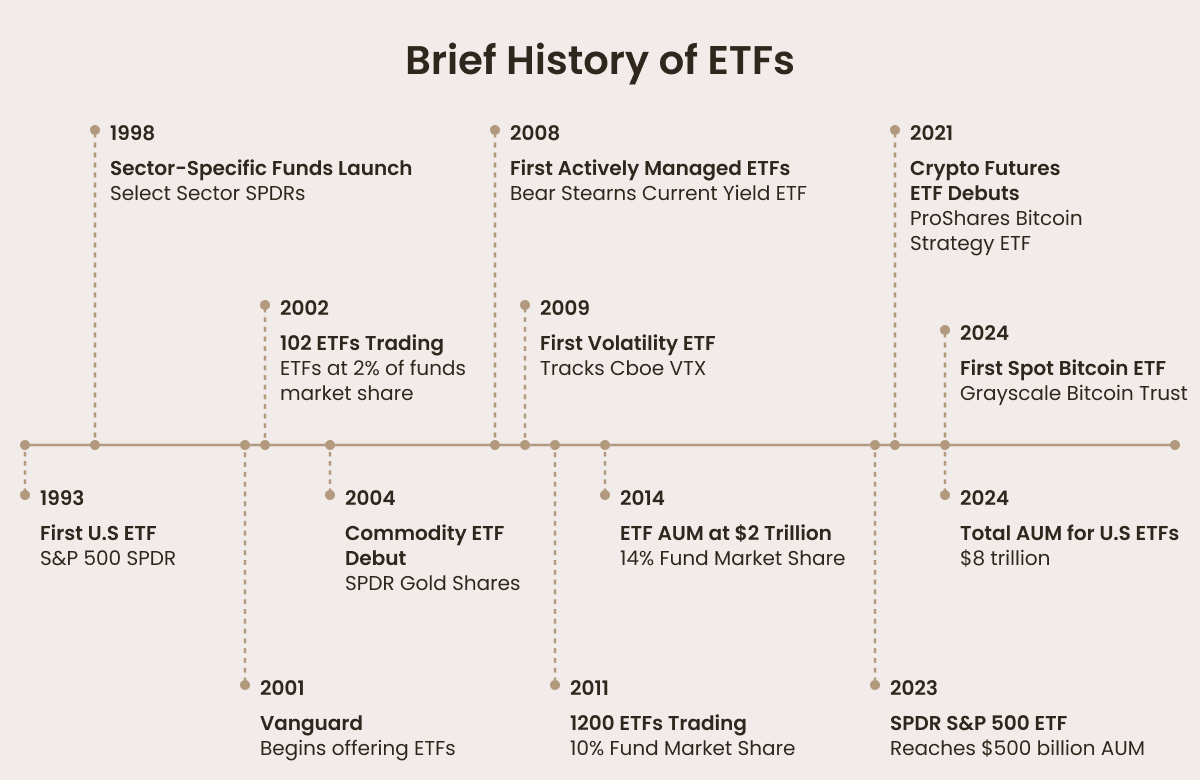

Since their creation in the early 1990s, exchange-traded funds (ETFs) have transformed the way we see investing. Today, they are one of the most popular financial products, diverse and cost-effective for investors from all over the world. But how did ETFs come about? Let’s take a look at their history.

The concept of ETFs emerged in the late 1980s when Nathan Most, an American Stock Exchange (AMEX) executive, created a product that combined the benefits of index investing with the flexibility of stock trading. He aimed to allow investors to buy and sell entire indices as easily as individual shares. However, early efforts were faced with resistance. Vanguard founder John Bogle, for example, doubted the suitability of index funds for intraday trading.

Nevertheless, the first ETF was launched in Canada in 1990. The TIP 35 fund tracked the Toronto Stock Exchange Index, and this paved the way for the global ETF boom.

In the US, the first ETF appeared in 1993. It was the SPDR S&P 500 ETF (SPY), developed by State Street Global Advisors. SPY was designed to track the S&P 500 Index and became an instant success. SPY remains one of the most heavily traded ETFs in the world to this day.

The 1990s and early 2000s saw a surge in ETF innovation.

Fixed-income ETFs were introduced in 2002, allowing investors to access bond markets easily, followed by commodity ETFs like the SPDR Gold Trust (GLD) two years later, which added physical assets like gold.

Over the decades, ETFs have grown exponentially. By 2021, global ETF assets surpassed $8 trillion, with nearly 7 000 funds available. Today, investors can get any ETF of every asset class, ranging from equities and bonds to real estate and commodities.

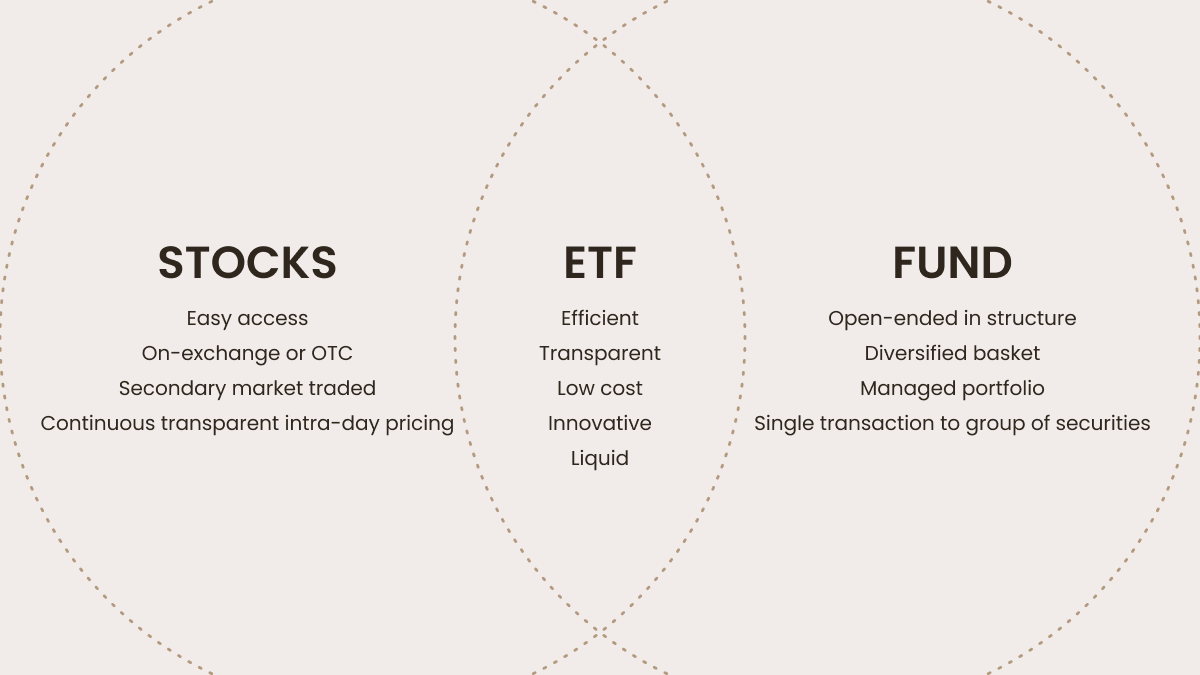

How ETFs work

When you invest in an ETF, you own shares of the fund but not the underlying assets directly. This means that if you invest in an ETF that tracks a stock index like the S&P 500, you don’t own the individual stocks within the index. However, you may still receive dividends from the stocks included in the index.

If you invest in Vanguard's Consumer Staples ETF (VDC), you simultaneously invest in 104 companies that are part of the MSCI US Investable Market Consumer Staples 25/50 Index. This ETF holds shares in well-known companies like Procter & Gamble, Costco, Coca-Cola, Walmart, and PepsiCo. If you invest $1.00 in VDC, you own $1.00 worth of shares that represent all 104 companies in the fund.

It’s also important to remember that although ETFs aim to match the performance of their underlying asset, their trading price may differ slightly from the asset’s actual value due to market activity. Additionally, long-term ETF returns might vary from the performance of the underlying assets due to fund expenses.

ETFs normally have lower fees than other types of funds, and are often considered cost-effective. However, the level of risk varies depending on the type of ETF.

Key features:

Market Pricing of ETFs is determined throughout the trading day, unlike mutual funds, which are priced once daily after markets close.

Most ETFs in the U.S. have an open-ended structure, meaning there’s no limit to the number of investors who can participate.

ETFs are regulated. They must be registered with the Securities and Exchange Commission (SEC) and often operate under the Investment Company Act of 1940.

ETFs (exchange-traded funds) function as follows:

The first step is asset selection, when the ETF provider chooses a basket of assets, such as the consumer staples companies in the VDC example, and organizes them into a fund with a unique ticker symbol.

Then, investors buy shares in the ETF that represent a portion of the fund’s total assets.

Finally, the shares of the ETF are traded on stock exchanges just like stocks. This makes them easy to buy or sell during the trading day.