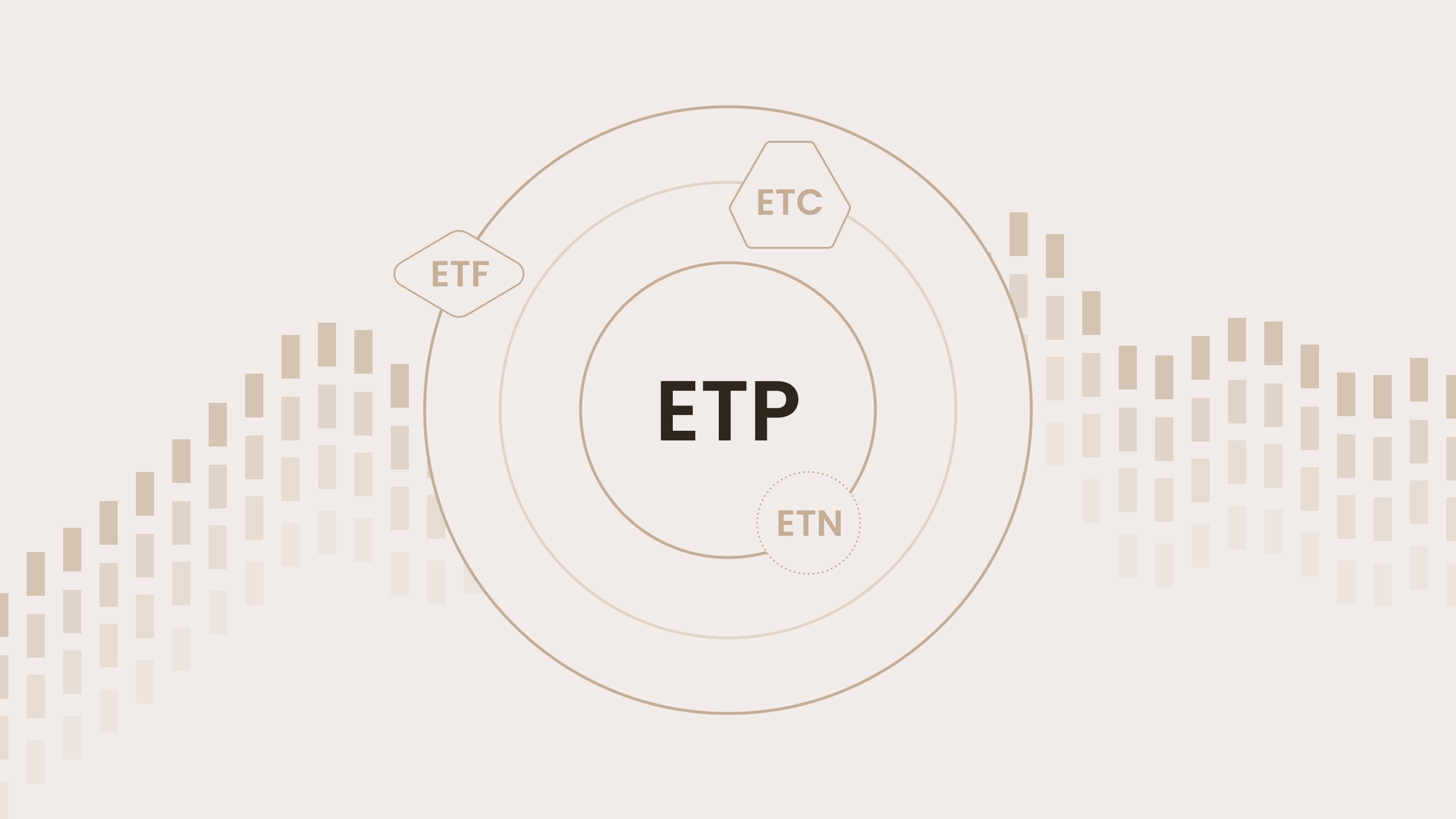

Nota dagangan bursa (ETN)

ETN berfungsi dengan cara yang sedikit berbeza. Ia tidak mempunyai aset pendasar, sebaliknya ia instrumen hutang tidak bercagar yang terikat dengan prestasi indeks pasaran atau penanda aras lain. Oleh kerana ETN dikeluarkan oleh institusi kewangan, ia membawa risiko kredit, yang bermaksud pulangan anda bukan sahaja bergantung pada prestasi indeks, tetapi juga pada kestabilan kewangan penerbit. Walaupun ia tidak memiliki aset seperti halnya ETF, ETN cara yang cekap untuk mengakses strategi atau pasaran niche tertentu.

Komoditi dagangan bursa (ETC)

Jika anda tertarik dengan komoditi seperti emas, perak, atau minyak tetapi tidak mahu bersusah payah menguruskan aset fizikal, ETP komoditi mungkin pilihan yang sangat baik. Produk-produk ini menjejaki nilai komoditi fizikal, membolehkan anda mendapat manfaat daripada perubahan harga tanpa perlu menyimpan atau mengendalikan komoditi itu sendiri. Ia sangat popular dalam kalangan pelabur yang ingin melakukan lindung nilai melawan inflasi atau mempelbagaikan portfolio mereka dengan aset nyata.

Cara ETP berfungsi

ETP direka untuk mencerminkan prestasi penanda aras tertentu. Ini dicapai menerusi pelbagai cara berbeza.

Kaedah replikasi

Produk dagangan bursa menggunakan dua pendekatan utama untuk menjejaki penanda aras mereka. Yang pertama ialah replikasi fizikal, di mana ETP sebenarnya memiliki aset pendasar. Sebagai contoh, ETF yang menjejaki S&P 500 akan memegang saham dalam semua 500 syarikat yang ada dalam komposisi indeks tersebut. Pendekatan yang kedua ialah replikasi sintetik, yang bergantung pada derivatif kewangan seperti swap untuk meniru prestasi yang diingini. Walaupun ETP sintetik memperluaskan akses kepada pasaran yang sukar untuk ditiru secara fizikal, ia datang dengan lebih banyak kerumitan dan risiko pihak lawan (counterparty risk).

Penyesuaian dengan pasaran

Satu lagi ciri menarik ETP ialah keupayaan mereka untuk menyasarkan segmen tertentu dalam pasaran. Sesetengah daripadanya memberi tumpuan pada sektor tertentu, seperti teknologi atau penjagaan kesihatan, sementara yang lain mengkhusus dalam kelas aset tertentu seperti emas, minyak, atau bahkan matawang kripto. Di samping itu, ETP boleh mewakili aset berprestasi tinggi sesebuah negara, seperti saham cip biru atau bon kerajaan, yang mendedahkan pelabur kepada pasaran antarabangsa. Fleksibiliti ini membuka pintu kepada strategi pelaburan yang disesuaikan, sama ada anda ingin mengembangkan kekayaan anda dalam sektor berpotensi tinggi, melindungi nilai daripada risiko, atau mempelbagaikan portfolio secara global.

Metrik seperti kecairan, volum perdagangan, dan nisbah perbelanjaan juga memainkan peranan penting dalam membantu pelabur menilai sama ada ETP tertentu sejajar dengan matlamat kewangan mereka.

Kebaikan dan keburukan ETP

Seperti mana-mana instrumen kewangan, produk dagangan bursa mempunyai kelebihan dan kelemahan tersendiri. Berikut beberapa renungan yang seimbang untuk membantu anda menimbang pilihan anda.

Pro |

Kecairan: ETP didagangkan sepanjang hari di bursa saham, memudahkan pelabur untuk masuk atau keluar posisi. | Ketelusan: Laporan yang kerap tentang pegangan memastikan anda tahu dengan tepat apa yang anda laburkan. | Kepelbagaian: Dengan satu ETP, anda boleh mengakses pelbagai kelas aset, pasaran, atau sektor, menjimatkan masa dan usaha anda. | Kos yang rendah: Berbanding dengan dana yang diuruskan secara aktif, ETP sering mengenakan fi yang lebih rendah, meningkatkan pulangan bersih anda. |

Kontra |

Turun naik pasaran: Sama seperti saham, harga ETP boleh turun naik sepanjang hari perdagangan, ini mungkin tidak sesuai untuk pelabur yang menghindari risiko. | Ralat penjejakan: Kadang-kadang prestasi ETP tidak sepadan dengan penanda arasnya, yang boleh menyebabkan percanggahan kecil dari masa ke masa. | Risiko kredit: Ini adalah kebimbangan yang utama berkaitan ETN, kerana ia bergantung pada kebolehpercayaan kredit institusi yang menerbitkannya. |

Dengan memahami pelbagai jenis ETP, cara ia berfungsi, serta pro dan kontranya, anda akan lebih bersedia untuk memutuskan sama ada ia sesuai dengan rancangan pelaburan anda. Dunia produk dagangan bursa penuh dengan potensi. Sama ada anda pelabur kali pertama atau peserta pasaran berpengalaman, kemungkinan terdapat ETP di luar sana yang sepadan dengan matlamat kewangan dan toleransi risiko anda.

ETP berbanding produk kewangan lain

Produk dagangan bursa menawarkan kelebihan unik berbanding instrumen kewangan lain. Tidak seperti dana bersama, yang hanya didagangkan pada penghujung hari, ETP boleh dibeli dan dijual sepanjang hari perdagangan, memberikan harga masa nyata dan fleksibiliti yang lebih tinggi. Mereka juga cenderung untuk mengenakan fi pengurusan yang lebih rendah, yang boleh membantu mengurangkan kos pelaburan keseluruhan.

Berbanding dengan saham individu, ETP menonjol kerana manfaat kepelbagaian mereka, membolehkan pelabur mengakses pelbagai aset atau keseluruhan indeks pasaran melalui satu produk. Gabungan kemampuan, kebolehdagangan intrahari, dan kepelbagaian ini menjadikan ETP pilihan yang menarik bagi ramai pelabur.

Ringkasan

ETP adalah penyelesaian moden dan fleksibel untuk pelabur yang ingin mempelbagaikan portfolio mereka dan mendapatkan pendedahan kepada pelbagai aset. Sama ada anda membeli komoditi seperti emas, menjejaki indeks saham, atau meneroka pasaran bon, ETP menyediakan cara mudah untuk mengakses peluang ini tanpa kerumitan pemilikan langsung.

Jika anda menghargai ketelusan, kebolehdagangan masa nyata, dan keberkesanan kos, ETP mungkin sesuai untuk strategi pelaburan anda. Luangkan sedikit masa untuk meneroka pilihan yang ada, dan anda mungkin mendapati bahawa produk serba boleh ini membuka pintu ke satu dunia baru yang penuh dengan peluang pelaburan untuk anda.

Memandangkan anda telah mendapat pemahaman yang lebih baik tentang cara ETP berfungsi dan apa yang menjadikannya istimewa, apa kata jika anda ambil langkah yang seterusnya? Tinjau pelbagai ETP yang tersedia di pasaran dan lihat jika selaras dengan matlamat kewangan anda.

.jpg)