Pantau USDMXN! Peluang trading berpotensi besar sedang menanti!

Pasangan USDMXN, yang mewakili kadar pertukaran antara dolar AS dan peso Mexico, adalah indikator kewangan kritikal yang mencerminkan kesihatan ekonomi kedua-dua negara tersebut. Dolar AS dipengaruhi terutamanya oleh dasar Rizab Persekutuan dan data ekonomi seperti kadar guna tenaga kerja dan angka KDNK. Sebaliknya, peso Mexico sensitif terhadap perubahan situasi ekonomi domestik, termasuk imbangan dagang dan harga minyak lantaran peranan penting Mexico sebagai pengeksport minyak.

PMI Perkhidmatan ISM, 5 Ogos, 16:00 (GMT+2)

PMI Perkhidmatan ISM yang akan datang diunjurkan meningkat kepada 51, menunjukkan pertumbuhan, berbanding bacaan sebelumnya sebanyak 48.8. Jika unjuran ini menjadi kenyataan dan PMI melebihi jangkaan, ia akan memberi isyarat kemantapan sektor perkhidmatan AS yang kukuh, dengan itu meningkatkan keyakinan pelabur terhadap ekonomi AS. Ini boleh mengukuhkan dolar AS berbanding peso Mexico, berpotensi mendorong kenaikan kadar USDMXN sekiranya dolar meningkat. Sebaliknya, jika keputusan PMI lebih rendah daripada unjuran, menunjukkan aktiviti ekonomi yang lebih lemah daripada jangkaan, ini boleh menjejaskan keyakinan terhadap ekonomi AS. Senario sedemikian boleh menekan Dolar, menyebabkan pasangan USDMXN menurun kerana Dolar melemah berbanding Peso.

Keputusan Kadar Faedah Mexico, 8 Ogos, 21:00 (GMT+2)

Keputusan kadar faedah Mexico yang akan datang diunjurkan akan kekal stabil pada 11.00%.Jika Banco de México memutuskan untuk mengekalkan kadar tidak berubah, ia boleh mengukuhkan Peso Mexico dengan membayangkan kestabilan ekonomi. Selain itu, mengekalkan kadar pulangan yang menarik bagi aset-aset berdenominasi Peso boleh menstabilkan atau meningkatkan sedikit nilai Peso berbanding Dolar. Sebaliknya, jika kadar dinaikkan di luar jangkaan, ia mungkin akan memberikan rangsangan yang lebih tegas kepada Peso kerana kadar yang lebih tinggi menawarkan pulangan pelaburan yang lebih besar. Sebaliknya, penurunan kadar secara mengejut boleh melemahkan Peso dengan mengurangkan daya tarik aset-aset Mexico, meningkatkan kadar USDMXN apabila pelabur beralih arah mencari kadar pulangan yang lebih baik di tempat lain.

Kali terakhir Bank of Mexico mengubah kadar faedah daripada 11.25% kepada 11.00% adalah pada 21 Mac 2024, dan kadar USDMXN telah naik!

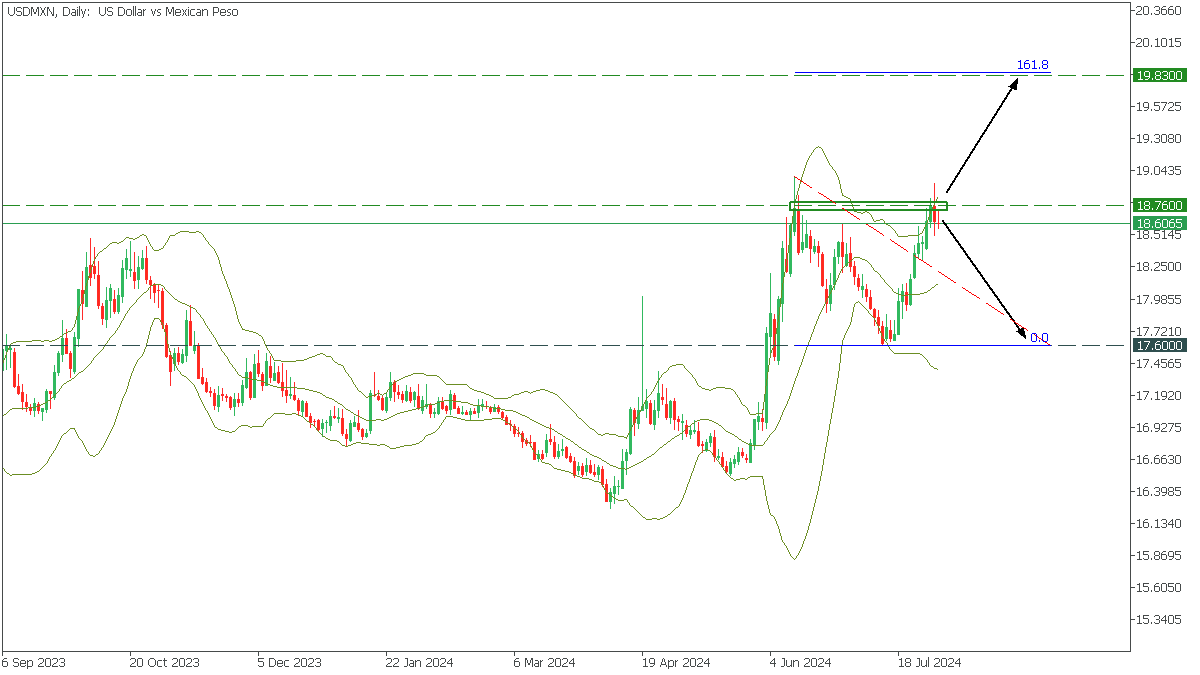

Pada rangka masa harian, USDMXN sedang mengukuh berhampiran zon rintangan penting selepas satu uptrend jangka pendek. Harga telah mencapai jalur atas Bollinger, tetapi sentimen bullish sangat kuat.

Jika harga menembusi rintangan 18.7600, sasarannya ialah 19.830, bersamaan dengan 161.8 Fibonacci;

Lantunan daripada rintangan tersebut akan membawa USDMXN menjunam kembali ke aras sokongan 17.6000;