Analisis Fundamental

Indeks Nasdaq 100 telah mencatatkan penurunan mendadak dalam sesi baru-baru ini, didorong terutamanya oleh peningkatan hasil bon Perbendaharaan A.S. Pada 21 Mei, hasil 30 tahun melonjak kepada 5.1%, paras tertinggi sejak 2023, berikutan lelongan bon 20 tahun yang menimbulkan kebimbangan mengenai peningkatan defisit fiskal A.S. Lonjakan hasil itu telah meningkatkan kos modal, yang amat membebankan saham pertumbuhan, terutamanya dalam sektor teknologi, menyebabkan Nasdaq turun 1.4% pada hari itu.

Analisis Teknikal

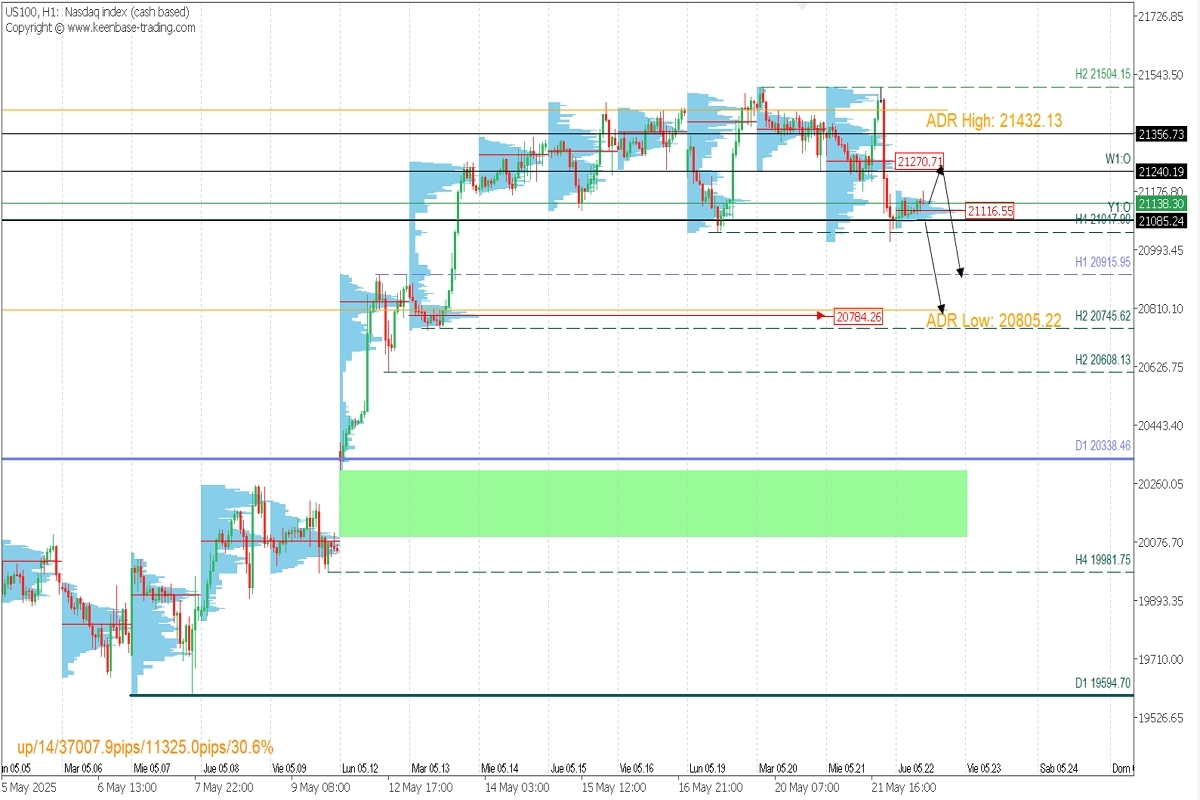

US100 | H2

Zon Bekalan (Jual): 21270

Zon Permintaan (Beli): 20784.26

US100 sedang mengukuh selepas penolakan teknikal (technical rejection) daripada aras rintangan utama 21504.15, menandakan kemungkinan terjadi pelemahan selanjutnya. Penurunan mendadak pada hari Rabu menembusi sokongan intrahari 21047.99, meninggalkan zon bekalan aktif di sekitar 21270.71. Aksi harga semasa menunjukkan volum dan mampatan harga tanpa momentum bullish yang jelas atau penerusan bearish pada peringkat ini.

POC (Point of Control) dari sesi sebelumnya pada 21116.65 menjadi aras jangka pendek yang akan menentukan apa yang terjadi seterusnya. Pergerakan bullish ke sebelah atas aras ini boleh membuka pintu kepada pemulihan menuju 21270.71, atau lebih tinggi jika bekalan diserap. Sebaliknya, penembusan ke sebelah bawah harga pembukaan tahunan (21085.24) akan membatalkan senario bullish dan mengaktifkan pergerakan bearish yang lebih mendalam ke arah 20915.95 dan 20784.26.

Ringkasan Teknikal

Senario Bullish:

Harga mesti menembus ke sebelah atas 21116.65 POC dengan momentum yang kuat. Jika disahkan, tolakan menaik ke arah 21270.71 dijangka berlaku. Walau bagaimanapun, zon itu kekal menjadi kawasan bekalan utama, jadi adalah dinasihatkan untuk memuktamadkan sebahagian keuntungan atau memperkukuhkan posisi long sebelum pengaktifan semula bearish (jika ia benar-benar terjadi).

Senario Bearish:

Jika harga turun dengan tegas di bawah harga pembukaan tahunan iaitu 21085.24, setup penerusan bearish akan terpicu aktif. Sasaran untuk langkah ini termasuk aras sokongan 20915.95 dan 20784.26. Senario ini akan terbatal jika harga merampas semula POC dengan volum yang besar.

Pola Ketandusan/Penyongsangan (ERP, Exhaustion/Reversal Pattern): Sebelum membuka urusniaga pada aras utama yang disebutkan, sentiasa tunggu pembentukan dan pengesahan ERP pada rangka masa M5, seperti yang dijelaskan di sini 👉 https://t.me/spanishfbs/2258

POC yang tidak didagangkan: POC = Point of Control (Titik Kawalan) adalah aras di mana kepadatan volum yang tertinggi berlaku. Jika harga bergerak turun daripada kawasan itu sebelum ini, ia dianggap sebagai zon jual dan bertindak sebagai rintangan. Sebaliknya, jika impuls menaik berasal dari titik itu, ia dilihat sebagai zon beli dan biasanya sejajar dengan aras-aras sokongan.

@2x.png?format=webp&quality=90)