AUD: the Chinese connection

Partners

So you reached an advanced level of trading currencies and started picking challenges for yourself, such as “I want to trade news about China but I don’t want trade CNH”. Is that your desire? No problem, Forex can make it come true. Trade the Australian dollar. You don’t see a link? Have a look.

The above chart is the H4 of AUD/JPY. The two vertical separators select the second part of January – that’s when the Coronavirus outbreak was registered and reached its peak. At the very end of January, the media were already commenting on the better outlook and the subsiding virus threat – although the number of the people contaminated (as well as the death toll) still kept rising as they are now.

The correlation is quite direct: the Australian economy heavily relies on the commodity and production exports to China. Hence, if there is a weakening demand from the Chinese side, there will be a drop in sales on the Australian side. As soon as such an expectation comes into play, the AUD drops, automatically pricing in the future shortcoming of the Australian revenues. Such an effect is boosted by the JPY, which goes in the opposite direction: the more the threat is to the global and regional economy, the stronger is the demand for the JPY as the safe-haven currency. Hence, the AUD/JPY correlation is the example of two opposite factors overlapping.

Still not convinced?

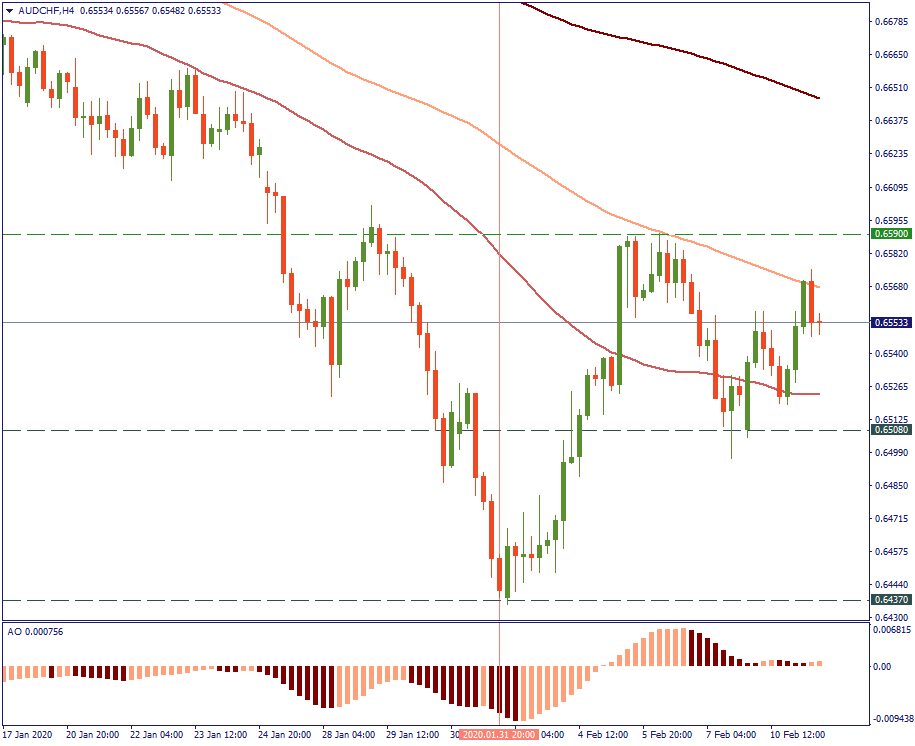

Here is the AUD/CHF. The vertical separator marks the same border between the virus emergency stages: the left side before the end of January shows the breakout, uncontrolled virus development, and unmeasured threat; the right side shows the “risk-containment” period and softer expectations. The same picture: the AUD loses value against the safe-haven CHF, then gains.

Ok, so what do you want me to do?

Trade the AUD. It’s a very interesting currency sensitive not only to global moves in the world economy but also to regional development, specifically in China. The latter is a big advantage in terms of making trades: China is always on the news radar, so there is little chance a significant event in that country is lost by the media, hence there is little chance you miss it. With the other major currencies, there is normally too much information affecting them (like with the USD or EUR), so it’s difficult to filter out individual factors of influence to trade them. In the meantime, AUD makes it easy to find and easy to act.

Can you be a bit more specific?

You want to levels - no problem. As we have discussed, the Coronavirus is still there, but it seems to be under control now. In any case, the market no longer sees it as a reason to continue the suppressed mode and flight to safety. Hence, the movement for the AUD against both the JPY and CHF is expected to be sideways to upside – as long as it is “quiet” and nothing else comes in.

With the AUD/JPY, the local support will be at 73.10 and the midterm one at 72.40. The upside is capped by the resistance of 100-MA in the area of 74.35.

With the AUD/CHF, the price is already testing the 100-MA, so the checkpoint for the bullish direction will be at 0.6590. Supports are at 0.6508 and 0.6437.

We will keep you posted with more interesting currency relations to help you navigate in the Forex world. Stay updated with FBS!