Gold: a temporary stop

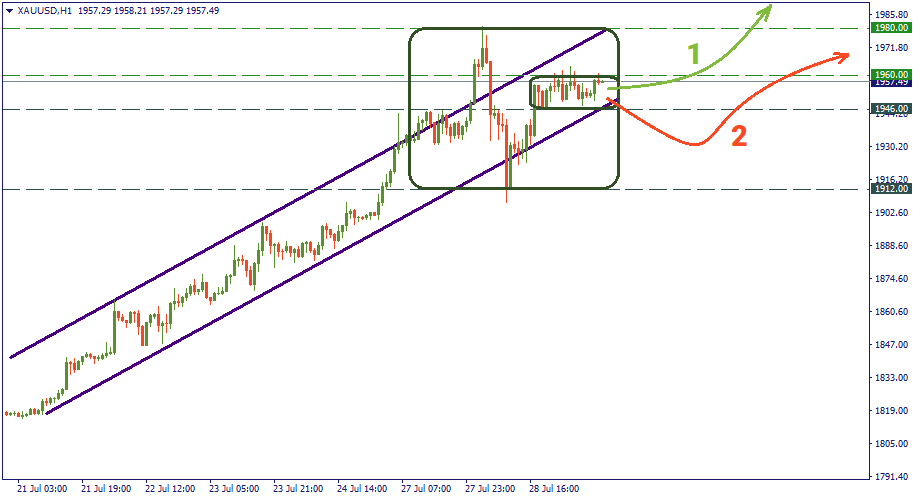

Gold has made significant advancements recently. A one-hundred-dollar distance was passed just within the previous week – the price went from $1 800 per ounce up to $1 900. This week, it even went beyond and reached $1 960 but there we see another type of behavior: fierce fluctuation and the eventual consolidation between $1 946 and $1 960. What are we to expect?

On the one hand, the flight to safe-haven has stopped to listen to the message the US Fed has to deliver today. There is nothing substantially new expected from the Chair Jerome Powell, but still, there may be hints – not about a change in the monetary policy, but rather about its perception of the current situation and the outlook.

On the other hand, the fundamental gravity of global recovery is not giving indications to go optimistic so far. That’s why, after a temporary consolidation below $1 960 gold will likely keep rising as per Trajectory 1. Alternatively, if there are certain positive elements in the Fed’s message, it may drop to certain extent, but unlikely lower than the support of $1 912. In the latter scenario, Trajectory 2 will be the one to expect.