USD/TRY: CBRK Keeps the Cash Rate

What happened?

On Wednesday, 14th of July, the Central Bank of the Republic of Turkey decided to keep the cash rate at the same level as the previous month, which is 19%. According to the opinion of the Central Bank, strict monetary policy will make a positive effect on the inflation level, which rose to 17.53% in June.

President Recep Tayyip Erdogan has the opposite opinion. He calls to cut interest rates this July or August, which raises a possibility of conflict between the Central Bank and the government. This tense situation makes the Turkish Lira a highly breathtaking asset to look for during this summer.

Technical analyses.

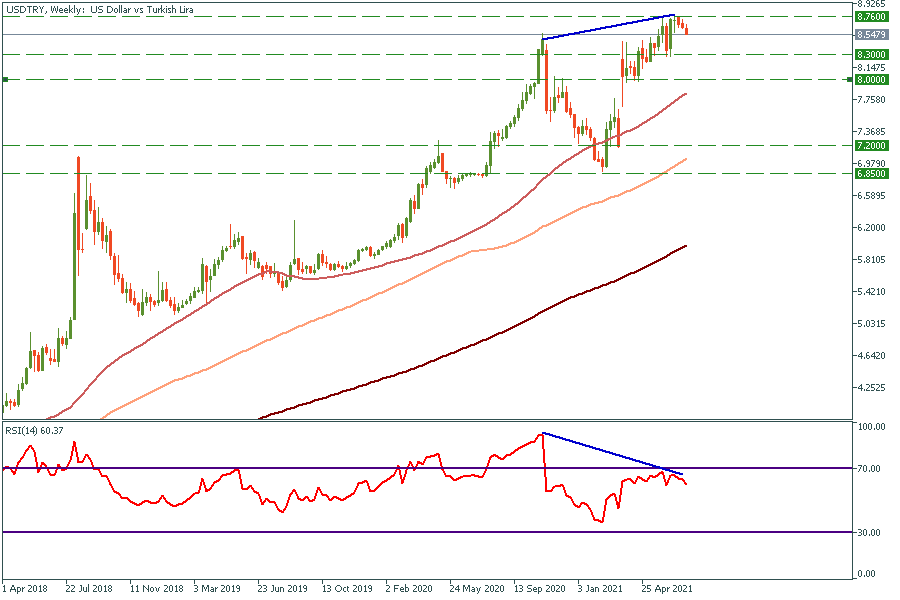

On the daily chart, USDTRY is trading above 50, 100, 200-day moving averages. At this moment currency pair is testing the 50-day moving average. On the one hand, if the price breaks through this support, it will drop down to the $8.3 support level, which is close to the 100-day moving average. In the worst-case scenario, it might fall to the 200-day moving average at the level of $8 or even try to close the gap at the level of $7.2.

On the other hand, if the price stays above the 50-day moving average, it will aim to $8.76 and try to update the all-time high.

On the weekly chart, the divergence between price and RSI occurred, which means the trend is about to change, or at least we will see a big correction to the downside.

In a conclusion, we need to see a break through 50-day moving average for selling with the first target of $8.3, the second target of $8, and the third one of $7.2.