Pengenalan

Dalam dunia perdagangan Forex yang dinamik, pemahaman tentang pola teknikal adalah penting untuk menyelusuri pasaran dengan efisien. Sebagai contoh, pola bendera bullish dan bearish adalah indikator penting bagi potensi pergerakan pasaran. Apabila pedagang mengenali pola-pola ini, mereka boleh membuat keputusan yang lebih termaklum dengan mentafsirkan trend harga jangka pendek yang menandakan dinamik pasaran yang lebih ketara. Artikel ini bertujuan menghapuskan tanggapan tentang kerumitan pola-pola bendera ini dan menawarkan pengetahuan kukuh kepada semua pedagang — tanpa mengira tahap pengalaman mereka —mengenai cara meramal dan memanfaatkan pergerakan pasaran dengan lebih efektif.

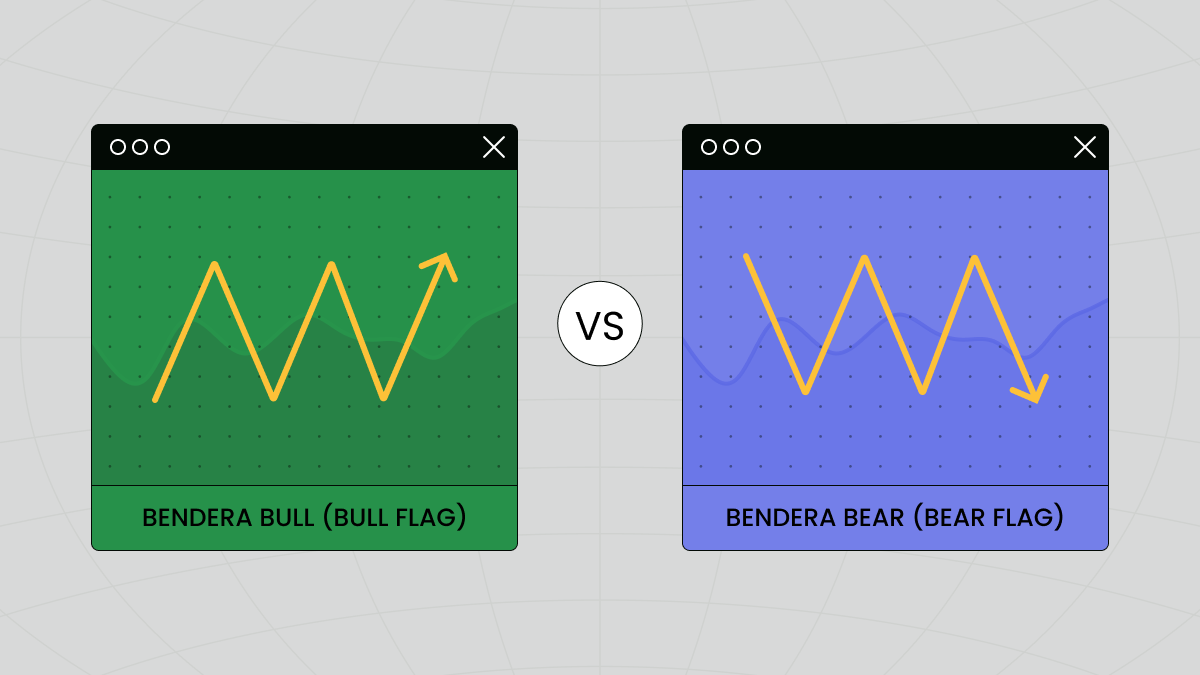

Apakah itu bendera bullish dan bearish?

Bendera bullish dan bearish adalah pola-pola penerusan jangka pendek dalam pasaran Forex. Pola-pola ini mirip sebuah bendera di atas tiang, yang menjelaskan namanya. Dalam Forex, bendera seperti ini menandakan potensi penerusan mengikut arah trend sebelumnya.

Bendera Bullish

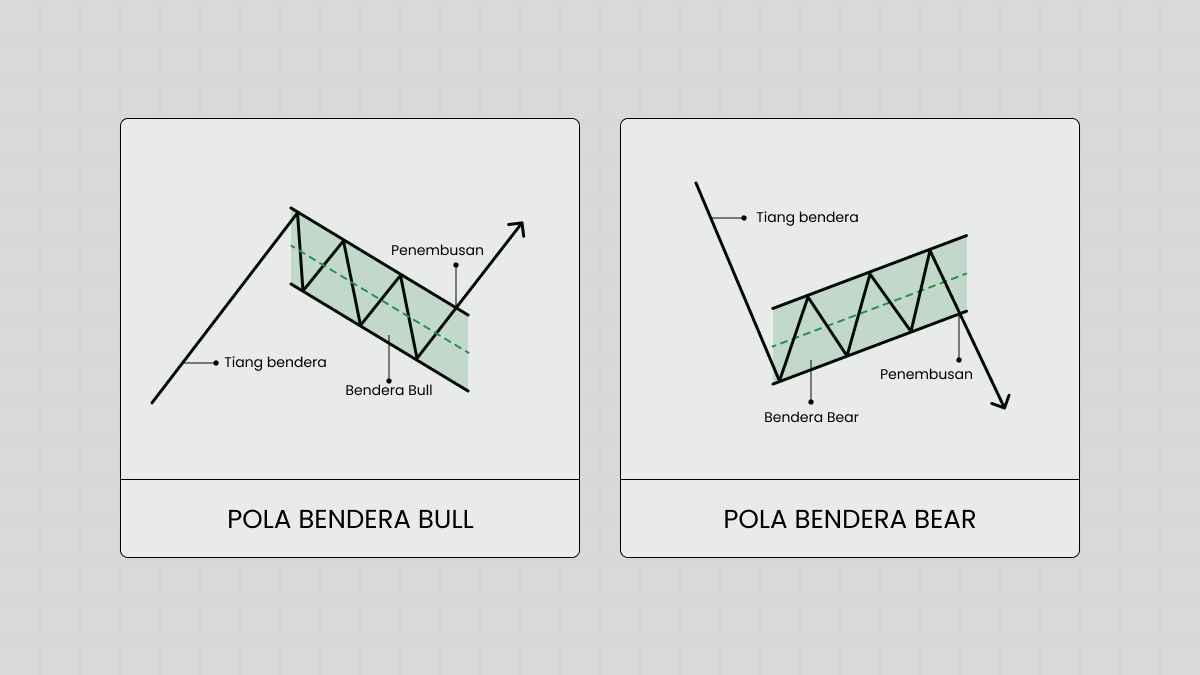

Pola bendera bullish terbentuk semasa downtrend dan menandakan potensi penyongsangan ke arah atas. Ia bermula dengan kenaikan harga curam yang mendadak, dikenali sebagai "tiang bendera", diikuti dengan penyatuan yang condong ke bawah dalam bentuk "bendera". Pola ini mencadangkan pasaran yang mengambil jeda pendek selepas lonjakan harga besar sebelum berkemungkinan meneruskan kenaikan tersebut. Biasanya, bendera bullish dianggap selesai setelah harga menembus ke atas melepasi sempadan atas bendera.

Bendera Bearish

Sebaliknya, pola bendera bearish berlaku semasa uptrend dan membayangkan pergerakan menurun yang akan datang. Seperti bendera bullish, ia bermula dengan penurun harta yang mendadak, seterusnya membentuk tiang bendera. Ini diikuti dengan penyatuan yang curam ke arah atas, mewakili bendera tersebut. Pola bearish menandakan bahawa pasaran sedang menyatu sebelum berpotensi meneruskan trajektori ke arah bawah. Pola ini disahkan apabila harga menembus ke bawah melepasi sempadan bawah bendera.

Kedua-dua pola bendera mempunyai:

- Tiang bendera: Pergerakan harga yang kuat sama ada menaik atau menurun.

- Bendera: Pergerakan bertentangan tiang bendera yang mewakili tempoh penyatuan. Ia boleh muncul sebagai garisan mendatar tetapi biasanya condong melawan arah pergerakan harga awal.

- Volum: Secara lazim, volum akan berkurang semasa pembentukan bendera dan meningkat semasa penembusan, mengesahkan kekuatan dan penerusan sesuatu pola.

Mengapa bendera bullish dan bearish penting?

Memahami bendera bullish dan bearish adalah penting untuk pedagang kerana pola-pola ini menyediakan cerapan kepada sentimen pasaran dan pergerakan harga berpotensi. Berikut adalah beberapa aspek penting yang mengesahkan kepentingan pola-pola ini dalam perdagangan:

Nilai ramalan

Bendera bullish dan bearish dihargai untuk nilai ramalannya semasa menentukan penerusan trend. Selepas penembusan mengenal pasti dan mengesahkan pola bendera, pedagang boleh menjangkakan trend untuk berterusan mengikut arah trend kuat yang sebelumnya. Keupayaan ramalan ini membolehkan pedagang melaraskan poin masuk dan keluar mereka dengan lebih strategi dengan potensi untuk membawa kepada keuntungan yang lebih tinggi.

Perdagangan kebarangkalian tinggi

Pola bendera adalah antara alat analisis teknikal yang paling andal. Oleh kerana ia mempunyai kadar kejayaan yang tinggi, ia digunakan oleh pedagang novis dan juga pedagang berpengalaman untuk membuat keputusan termaklum. Ia adalah mudah dikeasn dan diambil tindakan, mengurangkan kesamaran yang sering kali dikaitkan dengan pola-pola lain.

Pengurusan risiko

Satu kelebihan ketara bendera bullish dan bearish adalah sumbangannya kepada pengurusan risiko yang efektif. Struktur jelas pola-pola ini membolehkan pedagang menetapkan tahap Renti Rugi dan Ambilan Untung yang tepat. Sebagai contoh, Renti Rugi boleh diletakkan tepat di luar bendera di sebelah bertentangan penembusan, mengurangkan potensi kerugian jika penerusan yang dijangka tidak berlaku.

Menentukan masa untuk masuk dan keluar pasaran

Fasa penyatuan dalam pola bendera menawarkan peluang yang agak berisiko rendah untuk pedagang memasuki pasaran. Oleh kerana penembusan cenderung berlaku mengikut arah trend awal, pedagang boleh merancang kemasukan mereka semasa pembentukan bendera dan melaksanakan dagangan apabila harga menembus keluar daripada bendera. Keupayaan untuk menentukan masa adalah penting untuk memanfaatkan pergerakan harga pantas yang sering kali dikaitkan dengan pola-pola ini.

Serba suai merentas rangka masa

Bendera bullish dan bearish berkesan merentas pelbagai rangka masa, menjadikannya alatan serba sesuai untuk pedagang harian, pedagang swing dan pelabur jangka panjang. Walaupun anda menganalisis carta minit untuk dagangan pantas atau carta harian untuk strategi jangka panjang, pola-pola ini kekal relevan dan andal.

Jadi, bagaimana cara menggunakannya?

Menggunakan pola bendera bullish dan bearish secara efektif memerlukan mata yang tajam untuk perincian dan strategi yang kukuh untuk pelaksanaan. Berikut adalah beberapa langkah praktikal untuk menggunakan pola-pola ini dalam pendekatan perdagangan anda:

1. Kenal pasti pola

Langkah pertama ialah kenal pasti kehadiran pola bendera dengan tepat. Perhatikan pergerakan harga yang mendadak, yang membentuk tiang bendera, diikuti dengan fasa penyatuan lawan trend yang lebih kecil, yang membentuk bendera. Ingat, penyatuan secara ideal adalah kurang meruap dan terkandung dalam julat harga yang kecil.

2. Sahkan pola dengan volum

Volum memainkan peranan yang penting dalam mengesahkan kesahan pola bendera. Secara tipikal, volum seharusnya melonjak semasa pembentukan tiang bendera, berkurang apabila bendera terbentuk, dan menaik sekali lagi semasa penembusan. Pola ini dari segi volum membantu mengesahkan signal penerusan yang disediakan oleh penembusan harga.

3. Nantikan penembusan

Kesabaran adalah penting semasa berdagang dengan pola bendera. Tunggu sehingga harga menembusi pembentukan bendera sepenuhnya. Ini bermakna harga sepatutnya ditutup di luar sempadan penyatuan. Pembukaan pramatang sebelum penembusan disahkan boleh membawa kepada isyarat palsu dan potensi kerugian.

4. Tetapkan titik masuk

Setelah pola disahkan, tetapkan poin masuk anda:

- Bendera bullish: Buka posisi long selepas harga tembus ke arah atas bendera.

- Bendera bearish: Buka posisi short apabila harga jatuh ke bawah bendera.

5. Uruskan risiko dan tentukan sasaran keuntungan

Untuk mengurus risiko secara efektif, tetapkan pesanan Renti Rugi:

- Bendera bullish: Tetapkan Renti Rugi sedikit di bawah titik terendah dalam bendera.

- Bendera bearish: Tetapkan Renti Rugi sedikit di atas titik tertinggi dalam bendera.

Ambilan Untung boleh ditetapkan pada jarak bersamaan panjang tiang bendera ditambahkan pada titik penembusan, mengunjurkan pergerakan yang serupa selepas penembusan.

6. Pantau dagangan dan laraskan sebagaimana perlu

Apabila anda membuka posisi, pantau keadaan pasaran dan aksi harga dengan teliti. Jika pasaran menunjukkan tanda-tanda keadaan berubah atau jika pergerakan harga yang dijangkakan melangkaui unjuran awal, bersedia untuk melaraskan tahap Renti Rugi dan Ambilan Untung anda.

7. Semak semula dan belajar

Setiap dagangan menawarkan pengajaran yang berharga. Semak dagangan anda untuk memahami apa yang berkesan dan sebaliknya. Proses pembelajaran berterusan ini akan memperhalusi keupayaan anda untuk mengenal pasti dan memanfaatkan pola-pola bendera.

Soalan Lazim

Apakah itu bendera bearish?

Bendera bearish adalah pola bendera Forex yang ketara yang menandakan penerusan trend menurun. Pola ini, salah satu bendera bearish yang kritikal dalam Forex, terdiri daripada penurunan harga yang mendadak yang membentuk tiang bendera, diikuti dengan penyatuan menjalar yang condong ke atas. Pembentukan bendera bearish yang lengkap sering kali diikuti dengan penurunan harga lanjutan, menjadikannya pola yang kritikal untuk dikenali oleh pedagang Forex yang berharap untuk menghasilkan keuntungan daripada penurunan harga.

Apakah itu bendera bullish?

Bendera bullish ialah pola fundamental perdagangan Forex yang menandakan kemungkinan penerusan trend menaik. Pola bendera bullish yang prominen dalam Forex menampilkan kenaikan harga yang pantas (tiang bendera) dan fasa penyatuan berikutnya yang jatuh sedikit atau bergerak secara mendatar (bendera). Bendera bullish adalah signal kuat yang menandakan pembeli mungkin bakal mendapat semula kawalan, mendorong harga lebih tinggi dan merupakan keadaan yang biasa dilihat dalam analisis bendera Forex.

Bagaimana cara berdagang bendera bull dan bear?

Perdagangan bendera bullish atau bearish memerlukan pemerhatian yang tinggi dan titik masuk yang strategik. Untuk bendera bullish, pedagang harus mempertimbangkan pembukaan posisi beli setelah harga menembusi kawasan penyatuan, yang menandakan pola bendera bullish dalam Forex, mencadangkan momentum ke arah atas. Sebaliknya, membuka posisi jual selepas harga tembus ke bawah bendera boleh membawa keuntungan semasa berdagang bendera bearish, selaras dengan trend bearish yang ditunjukkan oleh pola bendera. Dalam kedua-dua keadaan, memahami bendera Forex dan pelaksanaan strategi Renti Rugi yang berdisiplin adalah penting untuk menguruskan risiko dengan efektif.

Kesimpulan

Pola bendera bullish dan bearish adalah elemen asas dalam set alat perdagangan untuk pedagang Forex yang berjaya. Kebolehannya untuk menandakan penerusan dalam trend pasaran menjadikannya alat yang berharga untuk meramal pergerakan pasaran dan melaksanakan dagangan kebarangkalian tinggi secara efisien. Seperti yang diterokai dalam artikel ini, memahami pola-pola ini dengan lebih teliti meningkatkan kemahiran analitis seorang pedagang dan menyediakan kelebihan strategik dalam menguruskan urusniaga secara efektif.

Pedagang yang menguasai pengesanan dan pentafsiran bendera bullish dan bearish boleh memanfaatkan pola-pola ini untuk membuat keputusan termaklum, menguruskan risiko dengan cermat dan mengoptimumkan hasil perdagangan mereka. Kunci kepada kejayaan dengan pola bendera terletak pada latihan berulang, pelaksanaan tepat dan pembelajaran berterusan. Dengan mengguna pakai pola-pola ini dalam strategi perdagangan anda, anda boleh meningkatkan keupayaan anda untuk menavigasi kerumitan pasaran Forex dan meningkatkan potensi keuntungan anda.

Di FBS, kami adalah komited untuk menyediakan alatan, sumber dan sokongan yang diperlukan oleh pedagang kami untuk berjaya dalam dunia dinamik perdagangan Forex. Kami menggalakkan anda untuk menggunakan cerapan daripada panduan ini untuk memperhaluskan strategi perdagangan anda dan memanfaatkan sepenuhnya peluang yang dipersembahkan oleh pola bendera bullish dan bearish.