.jpg)

Apakah itu belanjawan modal?

Belanjawan modal ialah proses memilih projek berdasarkan pulangan pelaburan (ROI, returns on investments).

Organisasi sentiasa berhadapan dengan cabaran untuk memilih antara beberapa projek yang bernilai untuk diberikan pelaburan. Mana-mana organisasi pasti ingin memilih semua projek yang menguntungkan sebagai sasaran pelaburan tetapi oleh kerana modal lazimnya terhad organisasi perlu memilih hanya beberapa daripadanya.

Seperti mana organisasi berhempas-pulas mencari projek yang terbaik untuk pelaburan mereka, orang ramai seperti kita juga perlu membuat keputusan pelaburan setiap hari, justeru belanjawan modal adalah satu konsep yang mempengaruhi kehidupan kita sehari-hari.

Sebagai contoh, komputer riba anda telah berhenti berfungsi. Anda boleh memutuskan untuk membeli komputer riba baharu atau baiki sahaja yang sedia ada. Ada kemungkinan terdapat komputer riba baharu yang harganya lebih murah daripada kos membaik pulih komputer sedia ada. Jadi, anda memutuskan untuk menggantikan komputer riba anda dan mencari komputer riba baharu yang sesuai dengan bajet anda!

Bagaimana Belanjawan Modal Berfungsi

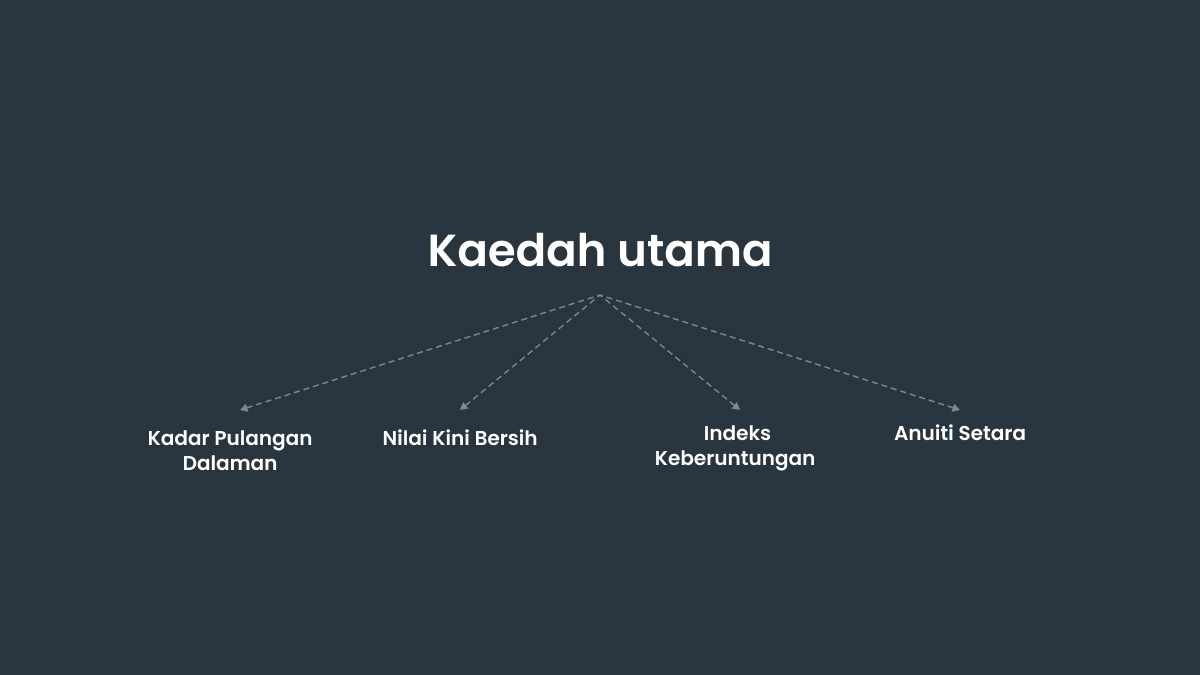

Matlamat utama belanjawan modal adalah untuk menentukan sama ada suatu projek itu akan membawa keuntungan kepada firma atau tidak. Prosedurnya boleh dilakukan dengan beberapa kaedah yang berbeza. Kaedah tempoh bayaran balik (PB, payback period), kadar pulangan dalaman (IRR, internal rate of return), dan nilai kini bersih (NPV) adalah kaedah-kaedah yang paling lazim. Selain itu, sesetengah organisasi mengira indeks keberuntungan (profitability index), analisis pilihan sebenar (real options analysis), anuiti setara (equivalent annuity).

Dalam situasi yang ideal semua kaedah ini akan memberikan dapatan yang sama, tetapi realitinya dapatan yang diperolehi sentiasa berbeza-beza. Bergantung pada keutamaan pengurusan dan kriteria pemilihan, lebih banyak penekanan akan diberikan pada satu pendekatan berbanding yang lain. Namun begitu, kaedah-kaedah penilaian yang digunakan secara meluas ini ada kelebihan dan kelemahan masing-masing.

Langkah-Langkah Lazim dalam Proses Belanjawan Modal

1. Mengenal pasti dan menilai potensi peluang

Setiap syarikat ada beberapa peluang pelaburan yang harus ia pertimbangkan. Sebagai contoh, syarikat yang mengeluarkan apa-apa produk, harus memilih sama ada untuk menghantar produknya melalui kapal, kapal terbang atau kereta api kepada pelanggan. Oleh itu, setiap pilihan mesti dinilai untuk melihat yang manakah yang paling wajar dari segi kewangan dan logistik. Setelah peluang yang paling munasabah dikenal pasti, syarikat harus menentukan masa yang sesuai untuk melaksanakannya, dengan mengambil kira faktor seperti keperluan perniagaan dan kos pendahuluan.

2. Anggarkan kos operasi dan pelaksanaan

Langkah seterusnya adalah menentukan kos projek. Proses ini memerlukan penyelidikan dalaman dan luaran. Jika syarikat sedang membangunkan pilihan pengangkutan, ia harus membandingkan kos pengangkutan sendiri dan kos menggunakan servis pengangkutan dari syarikat lain. Selepas ia memilih kaedah yang paling murah, ia mungkin cuba untuk mengecilkan lagi kos melaksanakan mana-mana pilihan yang ia pilih.

3. Anggarkan aliran tunai atau manfaat

Langkah seterusnya ialah menentukan berapa banyak hasil yang dapat dijana oleh projek baharu.

Varian pertama adalah untuk menyemak data tentang projek seumpamanya yang berjaya. Sekiranya projek itu tidak akan menjana wang sendiri, syarikat harus mengira jumlah wang yang boleh dijimatkan oleh projek ini dan memutuskan sama ada projek ini berbaloi untuk dilakukan atau tidak.

4. Menilai risiko

Syarikat perlu menganggarkan risiko yang berkaitan dengan projek itu. Di sini syarikat perlu memutuskan sama ada mereka bersedia untuk kegagalan projek berkenaan dan kehilangan semua wang yang dilaburkan dan membandingkan amaunnya dengan hasil yang berpotensi dipungut. Kegagalan projek seharusnya tidak menjejaskan keseluruhan proses aliran kerja syarikat tersebut.

5. Laksanakan

Sekiranya syarikat itu memutuskan untuk mengusahakan, satu pelan projek harus dirangka. Ia terdiri daripada kaedah pembayaran, kaedah pengesanan kos, proses untuk merekod aliran tunai atau manfaat yang dijana oleh projek. Pelan juga harus memasukkan garis masa projek, termasuk tarikh akhir (deadline).

Kaedah-kaedah utama

Tempoh bayaran balik

Tempoh bayaran balik ialah masa yang diperlukan untuk mendapatkan semula pelaburan awal. Contohnya, jika suatu projek memerlukan pelaburan $1 juta, tempoh bayaran balik menunjukkan berapa tahun yang diperlukan untuk aliran masuk tunai sepadan dengan aliran keluar $1 juta. Lebih pendek tempoh bayaran balik, lebih menarik projek berkenaan untuk pelaburan.

Syarikat biasanya menggunakan kaedah tempoh bayar balik (payback period method) apabila kecairan satu masalah yang serius. Jika syarikat mempunyai jumlah dana yang terhad, ia hanya boleh berurusan dengan satu projek besar pada satu-satu masa. Oleh itu, pihak pengurusan akan memberikan perhatian yang besar untuk mendapatkan semula pelaburan awalnya untuk dicurahkan ke dalam projek-projek seterusnya.

Terdapat beberapa batasan penggunaan kaedah PB. Pertama, tempoh bayaran balik tidak mengambil kira nilai masa wang (TVM, time value of money).

Satu lagi kelemahan lain ialah aliran tunai yang timbul di penghujung kitaran hayat projek, seperti nilai baki (residual value) yang dikecualikan dalam tempoh bayaran balik dan kaedah tempoh bayaran balik terdiskaun. Oleh itu, PB bukanlah satu indikator langsung bagi tahap keberuntungan.

Kadar Pulangan Dalaman

Kadar Pulangan Dalaman (IRR, Internal Rate of Return) ialah kaedah mendiskaun aliran tunai yang memberikan kadar pulangan projek. Kadar pulangan dalaman ialah kadar diskaun di mana jumlah kos tunai asal dan penerimaan tunai terdiskaun adalah sifar. Dalam erti kata lain, ia ialah kadar diskaun di mana nilai kini bersih (NPV) adalah sifar.

Jika projek yang berbeza mempunyai kos yang sama, syarikat akan memilih projek yang mempunyai IRR tertinggi. Apabila sesebuah organisasi perlu memilih antara beberapa projek yang mempunyai nilai yang sama, maka projek-projek ini akan diberikan ranking berdasarkan IRR dan yang paling menguntungkan akan dipilih. Sebaik-baiknya, syarikat akan memilih IRR dengan kos yang lebih tinggi daripada kos modal.

Nilai Kini Bersih

Nilai Kini Bersih (Net Present Value) dikira sebagai perbezaan antara nilai semasa aliran masuk tunai dan nilai semasa aliran keluar tunai dalam satu tempoh masa. Syarikat biasanya hanya mempertimbangkan pelaburan yang mempunyai NPV yang positif. Bagi senario di mana terdapat beberapa projek yang serupa, projek dengan NPV yang lebih tinggi akan dipilih.

NPV sangat dipengaruhi oleh kadar diskaun. Memilih kadar yang betul adalah kritikal untuk membuat keputusan yang betul. Ini harus mencerminkan risiko pelaburan, biasanya diukur dengan turun naik aliran tunai, dan mesti mengambil kira campuran pembiayaan. Amalan biasa dalam memilih kadar diskaun untuk projek adalah menggunakan WACC yang terpakai ke atas keseluruhan firma, tetapi kadar diskaun yang lebih tinggi mungkin lebih sesuai apabila risiko suatu projek itu lebih tinggi daripada risiko firma berkenaan secara keseluruhannya.

Indeks Keberuntungan

Indeks Pelaburan Keberuntungan (PI), juga dikenali sebagai Nisbah Pulangan Pelaburan (PIR) dan Nisbah Nilai Pelaburan (VIR), ialah nisbah pulangan yang dihasilkan dari pelaburan dalam projek yang dicadangkan. Ia adalah alat yang berguna untuk menyusun ranking projek kerana ia mengukur jumlah nilai yang dicipta bagi setiap unit pelaburan.

Anuiti Setara

Kaedah anuiti setara menyatakan NPV sebagai aliran tunai tahunan dengan membahagikannya dengan nilai semasa faktor anuiti. Ia sering digunakan apabila membandingkan projek-projek pelaburan yang memiliki jangka hayat yang tidak sama. Sebagai contoh, jika projek A mempunyai jangka hayat yang dijangkakan selama tujuh tahun, dan projek B mempunyai jangka hayat yang dijangkakan selama 11 tahun, adalah tidak wajar untuk hanya membandingkan nilai kini bersih (NPV) bagi kedua-dua projek melainkan projek--projek itu tidak dapat diulang.

Kesimpulan

Perdagangan FOREX boleh dinilai sebagai satu projek pelaburan, di mana seorang pedagang boleh dianggap seperti sebuah syarikat besar yang menyasarkan untuk menjana aliran masuk yang lebih besar daripada aliran keluar.

Perdagangan yang terancang dengan strategi yang dibina dengan baik adalah kunci kepada keuntungan jangka panjang dalam FOREX. Tidak kira kaedah mana pun yang digunakan, copy-trade, robot perdagangan atau berdagang sendiri secara manual, pengurusan risiko modal mesti dihormati oleh setiap pedagang.

FBS membolehkan anda berdagang dengan lebih daripada 1000 instrumen termasuk matawang kripto, logam, matawang dan juga saham. Alat-alat ini membolehkan setiap pedagang membina strategi yang menguntungkan.