Ringkasan

- Harga Semasa: ~$2,679

- Perubahan 24 Jam: +5.9%

- Trend: Bullish

- Indikator Momentum:

- Didagangkan di atas purata bergerak 50 hari (MA-50)

- RSI berada dalam zon bullish, menyokong penerusan kenaikan

- Aras Rintangan Utama:

- $2,950: Halangan terdekat; penembusan aras ini boleh mencetus pembelian

- $3,000: Rintangan psikologi dan kemungkinan dijadikan sasaran oleh institusi

- $4,800: Paras tertinggi sepanjang masa dan objektif bullish jangka panjang

- Aras Sokongan Utama:

- $2,250: Aras teknikal yang kukuh; jika ditembusi ia signal pelemahan jangka pendek

- $2,000: Sokongan psikologi dan kawasan trendline jangka panjang

Struktur bullish kekal utuh kecuali jika harga menembus ke sebelah bawah $2,250. Pergerakan berterusan di atas $2,950 boleh membuka laluan ke $3,000+.

Faktor-faktor Fundamental Yang Mempengaruhi Ethereum

- Upgrade Pectra:

- Upgrade Pectra Ethereum yang berjaya meningkatkan skalabiliti dan mengurangkan kos gas, meningkatkan keyakinan pelabur dan mengukuhkan dominasi Ethereum dalam infrastruktur kontrak pintar.

- Pengumpulan Whale:

- Pemain besar telah mengumpulkan 670,000 ETH dalam 9 hari terakhir, mencadangkan positioning oleh institusi untuk menghadapai kemungkinan penembusan.

- Sentimen Kripto Secara Umum:

- Lonjakan selera risiko pasaran secara keseluruhan, sentimen makro yang lebih baik, dan optimisme tentang pemulihan kewangan terdesentralisasi (DeFi) terus menyokong momentum kenaikan ETH.

Intipati Penting Untuk Trader

Ethereum kini sedang menumpang arus kekuatan teknikal dan fundamental, dengan pengumpulan ikan paus (whales) dan upgrade pada infrastruktur menghidupkan lagi sentimen bullish. Penembusan ke sebelah atas $2,950 boleh membawa kepada kenaikan deras menuju $3,200–$3,500, dengan prosepk jangka panjang yang menyasarkan $4,800. Pada sisi sebaliknya, penurunan melepasi $2,250 akan melemahkan prospek dan mengalihkan perhatian kepada $2,000.

Awasi:

- Aksi harga berhampiran $2,950

- Aktiviti on-chain dan yuran gas pasca-Pectra

- Signal pembelian oleh institusi dan berita ETF

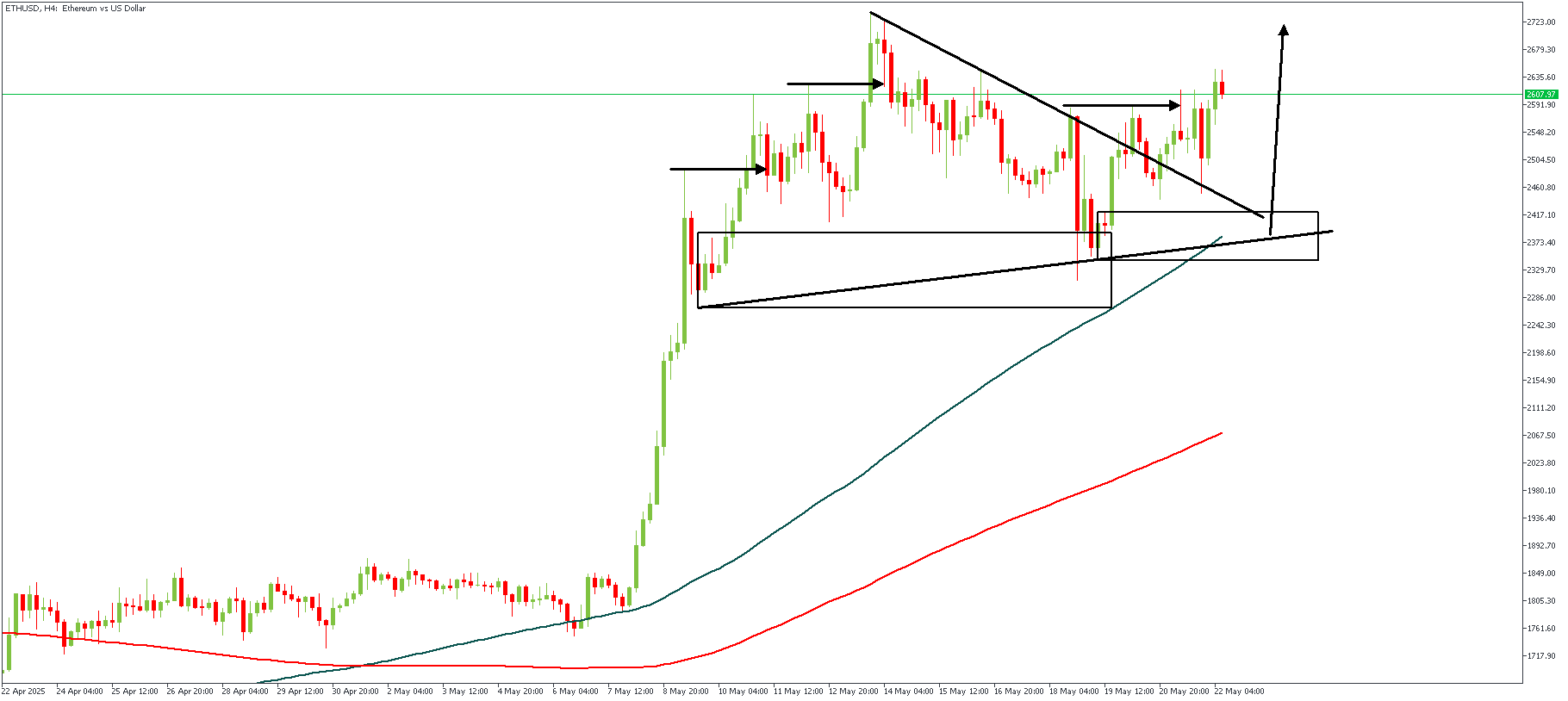

ETHUSD – Rangka Masa H4

Aksi harga ETHUSD telah menembus ke sebelah atas paras tertinggi struktur dalaman sebelum ini sejurus selepas ditepis (rejected) daripada zon permintaan dan sokongan garisan trend. Momentum semasa juga telah menembusi garisan trend rintangan, mewujudkan zon permintaan baharu – penolakan daripada kawasan permintaan baharu adalah pencetus yang diperlukan untuk mengesahkan sentimen menaik.

Jangkaan Penganalisis:

Arah: Bullish

Sasaran- 2721.62

Pembatalan- 2295.27

KESIMPULAN

Anda boleh akses lebih banyak idea trading dan berita terkini pasaran secara terus dalam saluran Telegram kami.