Technical Analysis

- Current ECB Interest Rate: 4.00%

- Rate Cut Probability (17th April Meeting): 90%

- Euro Performance: Surging in recent weeks

- Bond Yields & Energy Prices: Falling, easing inflation pressures

Fundamental Factors Affecting the Eurozone

- Impact of U.S. Tariffs

- It is expected to affect economic growth by disrupting trade and supply chains.

- Uncertainty increases the risk of undershooting the inflation target in the medium term.

- Retaliatory tariffs from the EU could cause short-term inflation spikes.

- ECB’s Policy Stance

- The bank has cut rates six times since June 2024.

- Open to further easing but cautious due to uncertain inflation outlook.

- Policymakers stress that caution does not mean gradual easing, suggesting potential decisive action if conditions worsen.

- Market Expectations for Rate Cuts

- Investors expect another rate cut on 17th April and two more later in 2025.

- Falling bond yields and energy prices support the case for easing.

- Geopolitical & Fiscal Uncertainty

- EU retaliation to U.S. tariffs could push inflation higher.

- Increased global fragmentation raises costs for businesses, adding inflationary pressures.

- Higher defense spending may boost demand and inflation.

Key Takeaway for Traders

- Short-term: The euro’s recent strength may stall if the ECB signals aggressive rate cuts.

- Medium-term: Trade disruptions & rate cuts could weaken the euro against major currencies.

- Long-term: If tariffs damage growth, the ECB may need to extend easing measures beyond 2025.

- FX Impact: A dovish ECB and economic slowdown could weigh on the euro, while a hawkish shift due to inflation risks could limit downside moves.

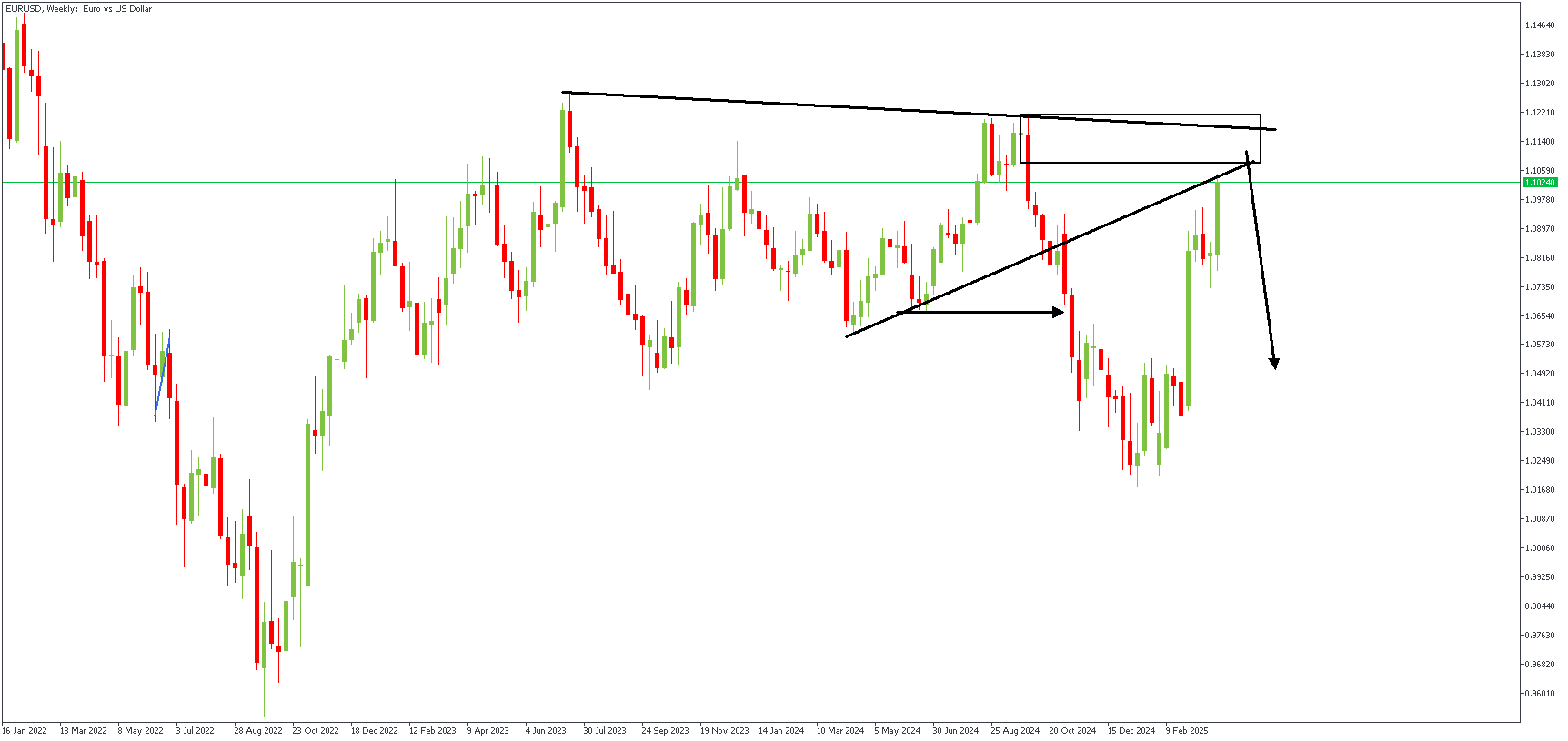

EURUSD – W1 Timeframe

The weekly timeframe chart of EURUSD shows the price currently resting within the supply region, with additional confluence from the double resistance trendlines. The Fibonacci retracement of the previous bearish impulse puts the supply zone at the 88% mark, setting the precedence for the bearish sentiment.

EURUSD – D1 Timeframe

.png)

On the daily timeframe chart of EURUSD, we see the SBR pattern formed at the tip of the swing high, with an FVG and inducement. The bearish sentiment is further justified by the presence of equal highs swept by the recent bullish leg of the retracement.

Analyst’s Expectations:

Direction: Bearish

Target- 1.04594

Invalidation- 1.12712

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.