Oil prices remained steady as expectations of potential U.S. interest rate cuts supported optimism for economic growth and fuel demand. Brent crude rose 0.3% to $79.98 per barrel, while WTI gained 0.3% to $77.21. The gains were limited by rising U.S. crude inventories and concerns over slowing global demand, particularly from China. Geopolitical risks in the Middle East, especially uncertainties regarding Iran’s potential response to recent regional tensions, continue to keep market sentiment cautious. Analysts remain focused on mixed economic indicators and potential rate cuts.

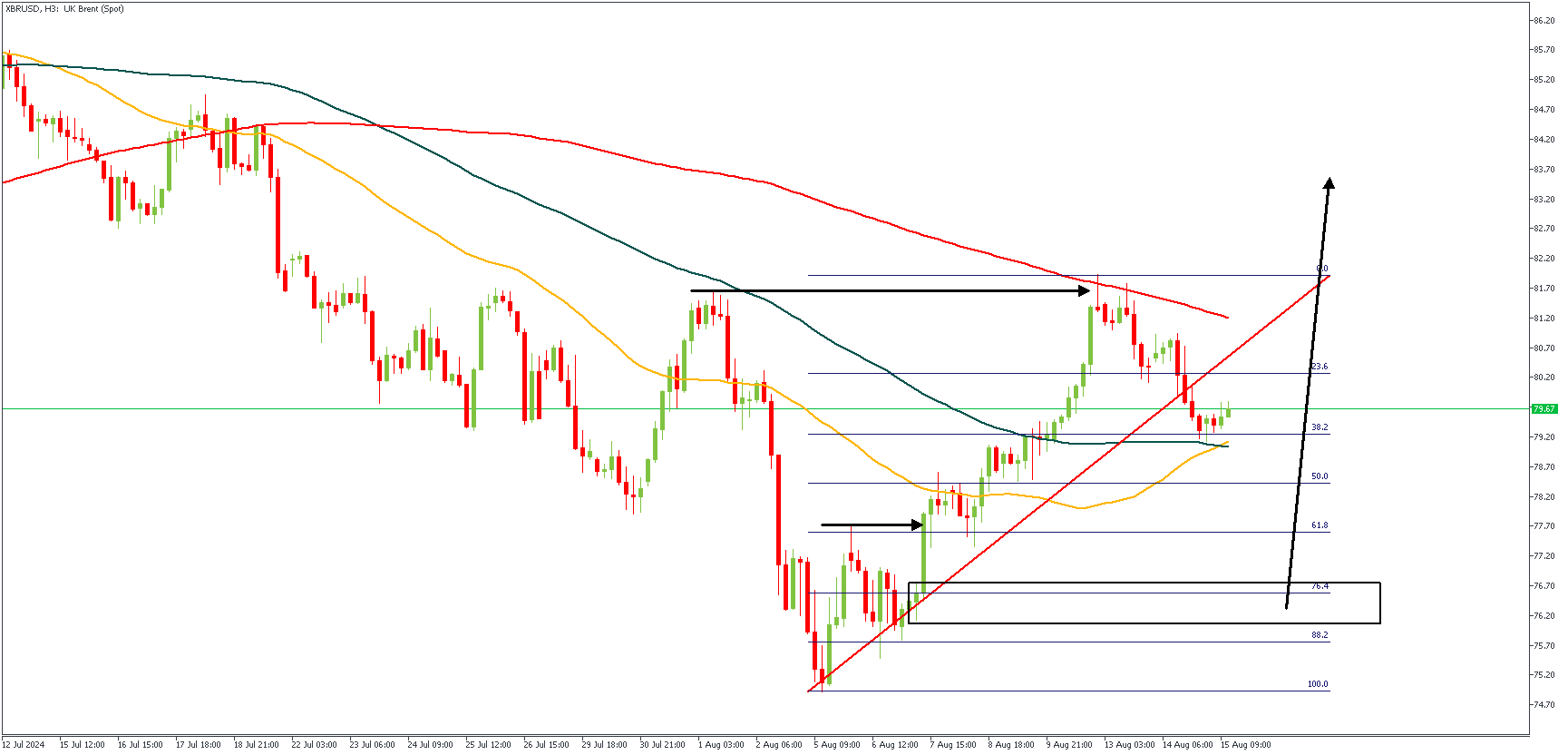

XBRUSD – H3 Timeframe

The chart above shows the price action on the 3-hour timeframe of UK Oil. The price action shows a recent rebound off the 200-period moving average right after a sweep of the buy-side liquidity from the highlighted high. In line with this, I expect to see prices drop further down, towards the 88% of the Fibonacci retracement tool before I can consider the entry for the bullish continuation on Brent.

Analyst’s Expectations:

Direction: Bullish

Target: 83.62

Invalidation: 74.70

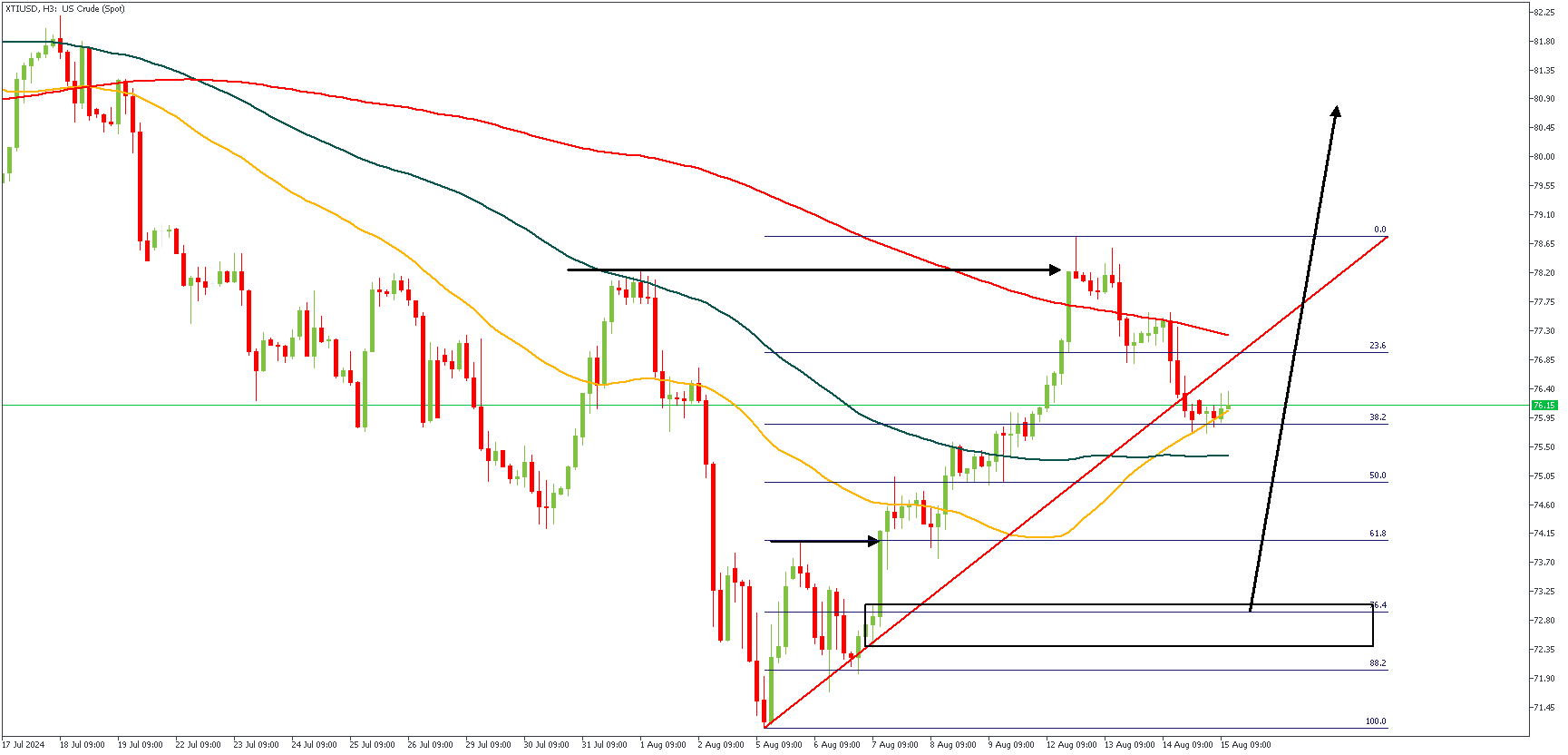

XTIUSD – H3 Timeframe

XTIUSD presents a very similar price action schematic to what we earlier saw on the Brent chart. The previous high at the horizontal arrow highlight has already been breached, with an initial rejection from the 200-period moving average, I expect to see prices slide towards the demand zone at the 76% of the Fibonacci retracement, before considering the possibility of a bullish entry from the demand zone.

Analyst’s Expectations:

Direction: Bullish

Target: 80.67

Invalidation: 70.60

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.