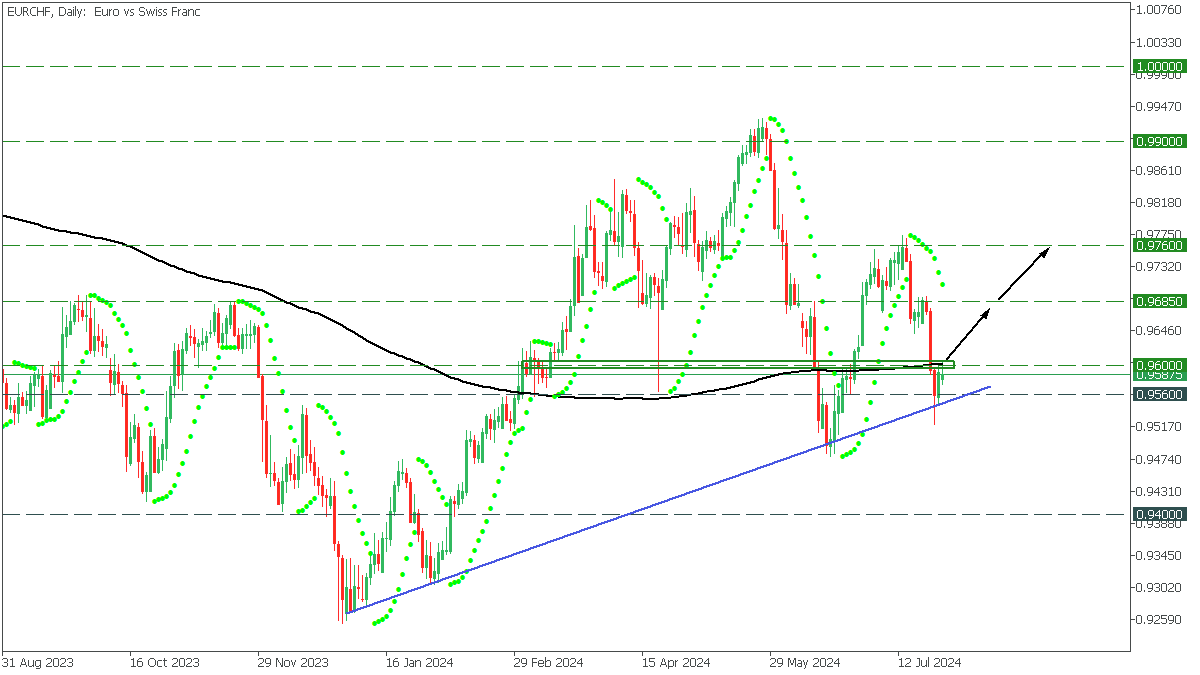

EURCHF, Daily

In the Daily timeframe, EURCHF was in a long-term uptrend after volatility fell to the trend line and bounced. Parabolic SAR indicates the possibility of a rise, and with the recent bounce from the trendline, we can expect further gains on a surge above MA200.

- EURCHF could be considered for a buy on a break above 0.9600 resistance and MA200 with a target of 0.9650;

- If the bulls push the price above 0.9650, the next target will be 0.9760;