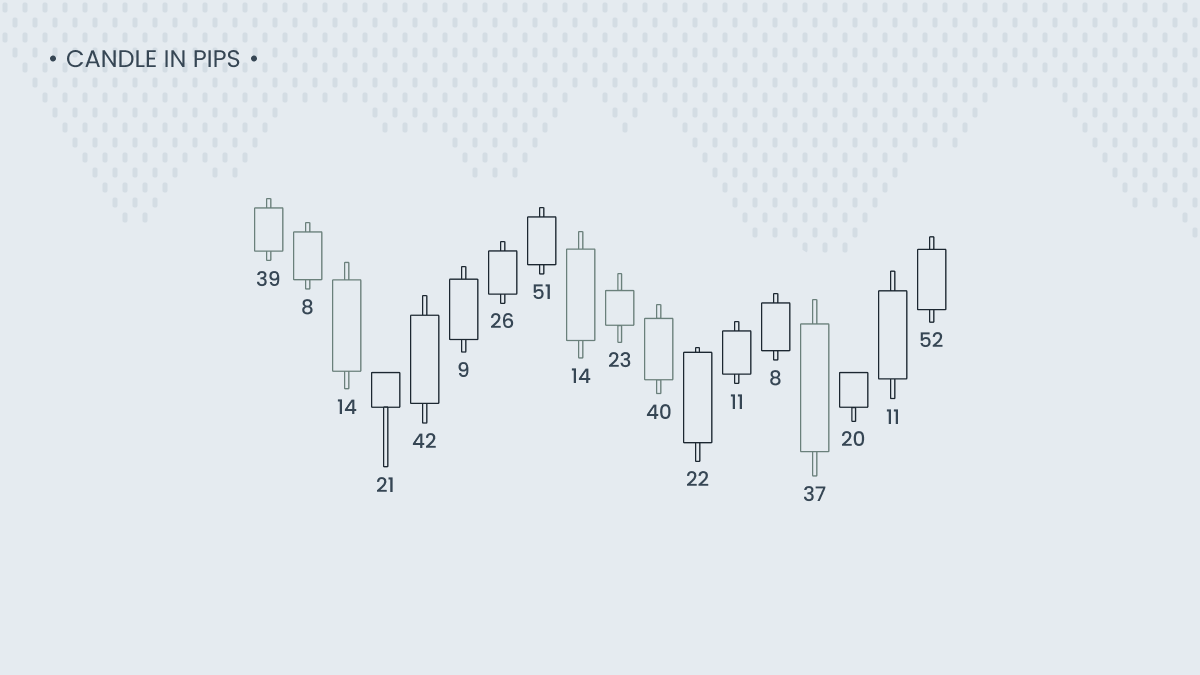

Make sure you are viewing the chart with enough zoom to place the cursor precisely on the candle’s extremes so you get an exact measurement. The number of pips may vary if you change your chart settings, such as candle types or price scale.

FAQ

What is the difference between a pip and a pipette?

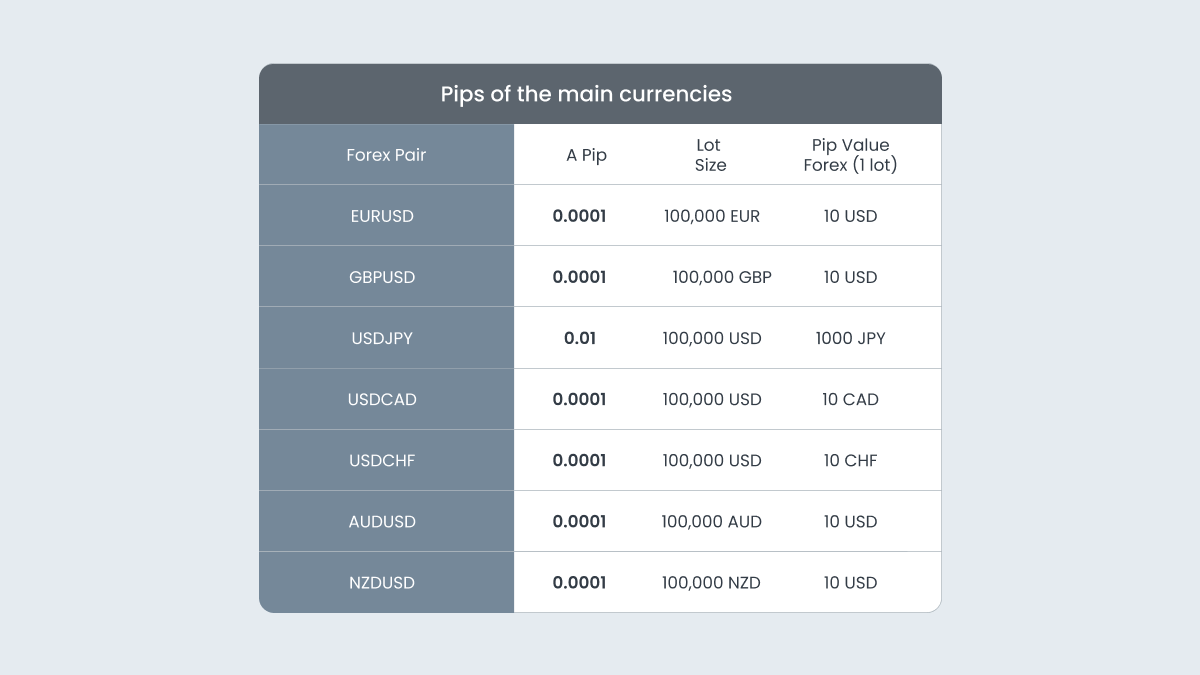

A pip, short for "percentage in point," is the standard small movement a currency pair can make. This is typically 0.0001 for most currency pairs, but 0.01 for pairs involving the Japanese yen. A pipette is one-tenth of a pip. If a pip is the fourth decimal place for most pairs, a pipette is the fifth decimal place (0.00001). For yen pairs, a pipette is the third decimal place (0.001).

How are pips used?

Pips are part of the exchange rate quote for a currency pair. They represent fluctuations in the quote, and the value of a position in the market that could have been taken. Imagine a hypothetical case where you bought a currency pair at 1.1356, and sold it at 1.1360. You gained four pips in your trade. Then, you would just need to calculate the value of a single pip, and multiply it by your lot size to get the dollar value of your profit.

Are there currency pairs that do not use 0.0001 as a pip?

Yes, the Japanese yen is a notable exception in the Forex market. That means all pairs that include the yen in their quotation follow a different convention for the value of a pip.

In most currency pairs, a pip represents a change of 0.0001 in the quote value. However, in pairs that include the Japanese yen, such as USDJPY or EURJPY, the quote extends only two decimal places beyond the decimal point.

In these pairs, a pip equals 0.01, not 0.0001. This is because, historically, the Japanese yen has had a much lower value compared to other major currencies, such as the US dollar or the euro. A change of 0.01 in the Japanese yen is, proportionally, more significant and appropriate to reflect fluctuations in the exchange rate, whereas a change of 0.0001 would be too small to be practical.

What is a pip value calculator?

A pip value calculator is a tool used in forex trading to determine the monetary value of a pip in the account currency for a currency pair. This calculation is important for risk management and overall trading strategy.

The pip value calculator helps traders understand how much a one-pip change will be worth in monetary terms in their trades. This is crucial when setting the position size and adjusting stop-loss and take-profit levels for trades.

How does it work?

Select the currency pair you are trading. Since different pairs have different pip values, it’s important to choose the correct pair for an accurate calculation.

Enter the trade size (in lots). The lot size directly affects the pip value: The larger the lot, the greater the pip value.

Some calculators require you to input the current exchange rate for the currency pair. This is necessary to convert the pip value from one currency to another, especially if the account currency is different from the base or quoted currency in the pair.

How does leverage affect the value of a pip?

Leverage is a financial tool that enables you to trade with more money than you have by using a fraction of the total position value in your account. For example, if you use 100:1 leverage with an investment of just $1000, then you can trade with $100 000. The increase in trading volume has a direct and amplified effect on the monetary value of each pip. That means small market movements can result in larger profits or losses than those that would have been possible with an unleveraged trade. When using leverage, even though the pip value in terms of the fourth decimal place (or the second for yen pairs) does not change, the monetary value of each pip does because the total position size is much larger.