Activision and EA are in the Game

Activision and EA are in Game

As the earnings season comes to its end, there are still companies worth looking for. Today Activision Blizzard and Electronic Arts are in the limelight of our analysis.

Over the last year gaming industry has increased even more and is expected to be worth $256 billion by 2025. Back in 2019, this figure was around $150 billion. This is almost 10% annual growth. Let’s run through the nearest reports from the biggest gaming companies.

Activision Blizzard Needs a Shoulder to Cry On

Activision Blizzard (ATVI) is scheduled to announce Q3 earnings results on Tuesday, November 2, 23:05 GMT+2. The consensus EPS estimate is $0.70, and the consensus Revenue Estimate is $1.88 billion. Over the last months, the company faced lots of claims on discrimination and abuse. The Equal Employment Opportunity Commission had accused the game company and ATVI has settled an internal investigation that costs $18 million.

However, ATVI has beaten estimates on EPS and revenue each time for the last 2 years. Despite economic reopening, video gaming engagement still remains high thereby pushing profits higher. The pressure on sales is present only due to supply shortages of the next-gen gaming consoles. Another possible bullish factor is that CEO Bobby Kotick took a pay cut ahead of the earnings report making it obvious that he is taking measures to address the publisher's problems.

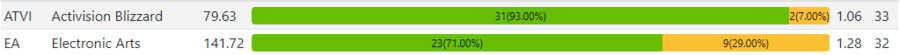

From the technical side, the company has formed inversed head and shoulders pattern. The retest of the shoulders line is also here, and amid a good report, the upside potential can be huge. However, we would recommend you wait for the earnings result, as trading before the report is more likely gambling.

ATVI daily chart

Resistance: 82.0; 83.5; 86.3

Support: 75.0; 72.0

EA Divorces With FIFA

Electronic Arts (EA) is scheduled to announce Q2 earnings results on Wednesday, November 3, 23:00 GMT+2. The consensus EPS estimate is $1.15, and the consensus Revenue Estimate is $1.74 billion. The sales increased significantly from the year before because of FIFA 2021 outperformance. Just like with ATVI, EA is feeling pressure from supply shortages, but the level of sales remains high. If the company can maintain that momentum when it reports other quarterly earnings, it will ease investor concerns that revenue would drop when people have more entertainment options away from home.

Electronic Arts and FIFA created a $20B video game empire. But the end is near. FIFA wants more money for the license, and EA wants the right to use the FIFA name for new ventures like video game tournaments and non-fungible tokens (NFT). For now, it looks like EA will have to change the name for the soccer franchise. Potentially it may be “EA Sports F.C.”. However, Electronic Arts is in a strong position with over 300 licensing agreements, including one with UEFA. This uncertainty may affect badly on the price, even though there weren’t any trend movements for more than a year.

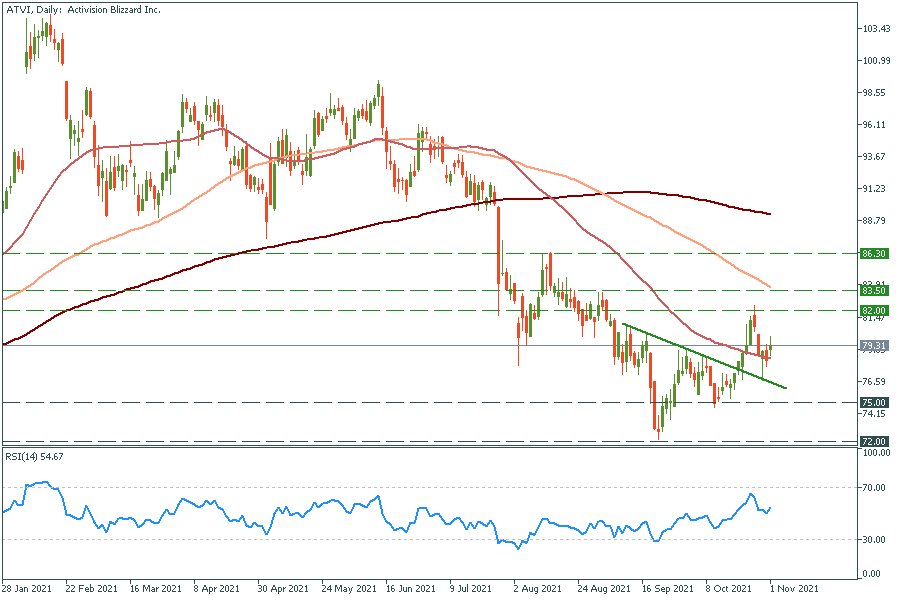

If to look at the chart, the consolidation went long. Although we saw a vast bearish swing a month ago and as most of the stop losses were eliminated by it, we suppose it is time for EA to surge. But wait for the report. Just as always it may surprise everyone.

EA daily chart

Resistance: 144.0; 147.0; 149.0; 150.0

Support: 133.0; 126.0

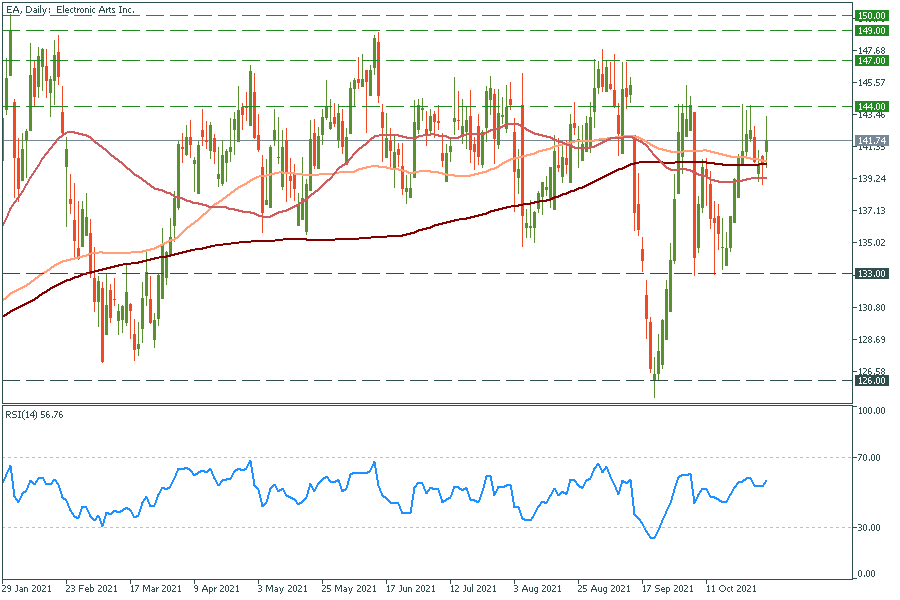

At the end of the day, most analytics think both stocks should rise in the longer term. For ATVI 31 out of 33 analytics marked the stock as “Buy”, and for EA “Buy” mark has been given by 23 out of 32 analysts.