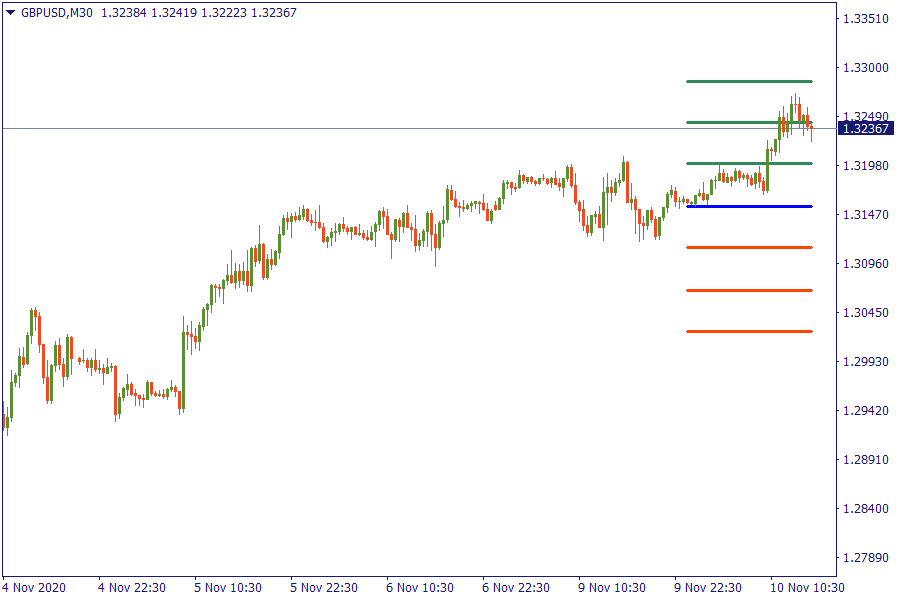

Cable climbs to fresh two-month high

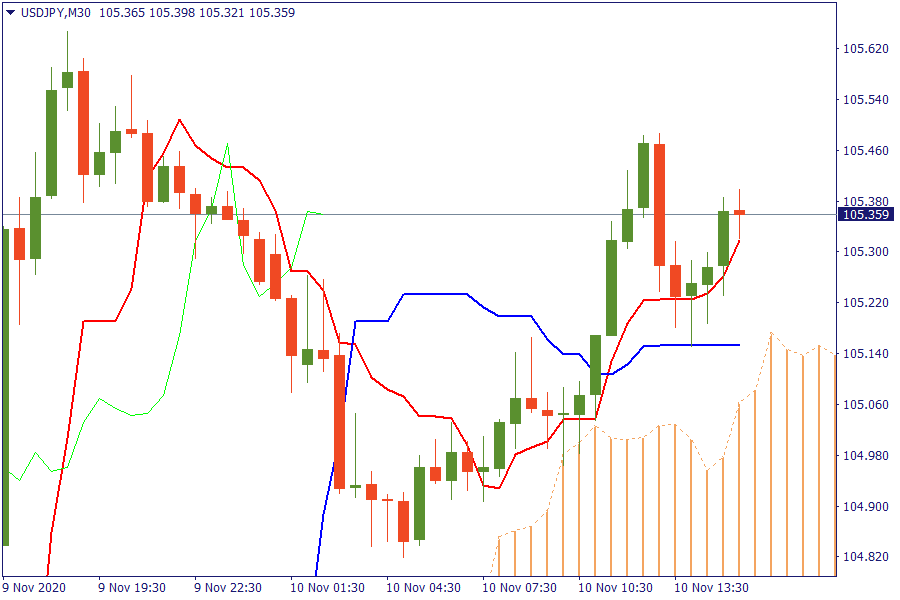

Ichimoku Kinko Hyo

USD/JPY: The pair is trading above the cloud. An upward pressure would lead the pair to exit further the cloud, confirming a new bullish outlook.

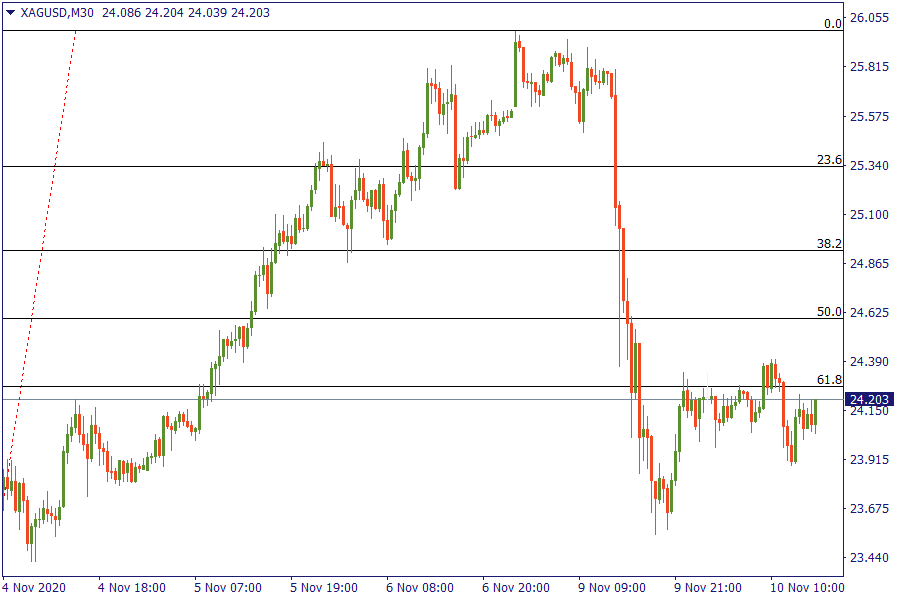

Fibonacci Levels

XAG/USD: Silver remains below 61.8% retracement area. Silver bulls after a remarkable sell off yesterday buy passively today.

US Market View

US stock markets are set to open mixed as the post-Pfizer rally is reassessed, but cyclicals are still clearly outperforming the growth and momentum names that have notched the biggest gains during the pandemic. The US registered over 100,000 new cases of Covid-19 for the fourth straight day on Monday, with surges in California, Texas and New Mexico. California Governor Gavin Newsom said the reopening process would have to be scaled back in some counties. Crude oil prices added to Monday’s gains on hopes that a Covid-19 vaccine will allow the reopening of the world economy to proceed earlier than thought. The European Union continued to set out its stall for the new US administration by reviving its threat to impose new sales taxes on digital companies if there is no international agreement on how to tax them.

The Trump administration had walked away from a multiyear process on work for a new framework agreement under the auspices of the Organization for Economic Cooperation and Development earlier this year.

The announcement comes a day after the EU imposed tariffs on Boeing and other U.S. producers in line with a WTO ruling that the aircraft maker received illegal support from the U.S. government. In Europe on Tuesday, German economic sentiment, as measured by the ZEW index, fell for a second straight month as Germany posted a new record of Covid-19 cases in intensive care.

UK job losses also hit a new monthly record and the jobless rate hit a four-year high as the government’s wage support scheme petered out.

USA Key Point

- The GBP is the strongest and the CHF is the weakest.

- EUR/USD falls to session low.

- French PM Castex to hold news conference on Thursday evening regarding virus situation in France.