NFP: USD getting even stronger?

Last time

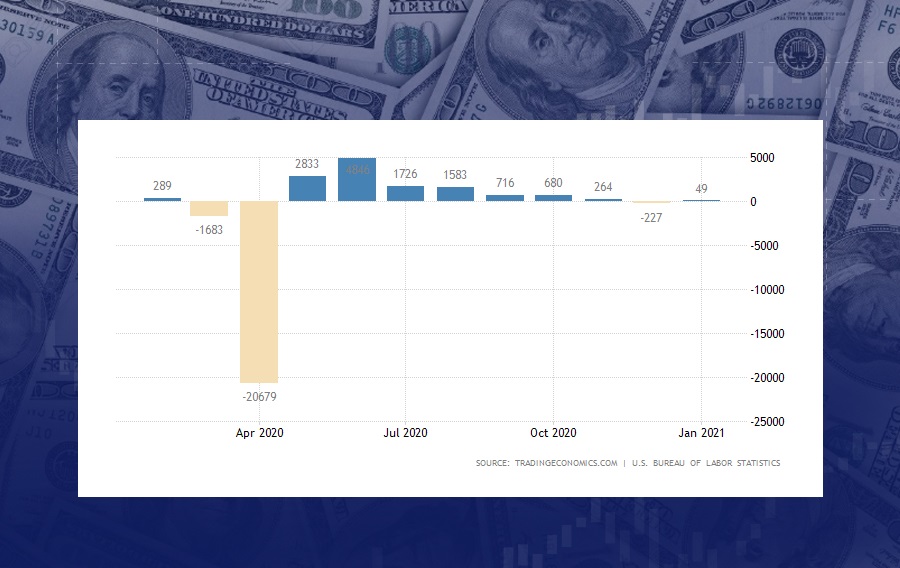

These were the figures released in the February NFP:

- Av. Hourly Earnings were 0.2% against the 0.3% expected

- Employment Change was 49K against 85K expected

- Unemployment Rate was 6.3% against the forecast of 6.7%

As the market was unimpressed with the data, the USD started losing value

In fact, it started depreciating before the release - the figures provided by the US Labor authorities just enhanced the effect. That's very visible on the chart below: EUR/USD rises in the marked period from 1.1980 to 1.2050 and keeps rising later on after a brief correction.

This time

Here is what observers expect:

- Av. Hourly Earnings to stay steady at 0.2%

- Employment to increase by 182K

- Unemployment Rate to stay steady at 6.3%

Action plan

- Join our top analyst Nour El Deen Al-Hammoury to trade the NFP live

- If the Average Hourly Earnings and Employment are higher and Unemployment Rate lower than expected, the USD is likely to rise

- If the Average Hourly Earnings and Employment are lower and the jobless rate greater than expected, the USD will soften

Weak NFP data drives the USD down; better-than-thought figures makes the USD stronger