Will the USD keep strengthening against safe havens?

Despite Monday’s optimism, a new day has brought some cautious moods to the market. It seems like rising bond yields keep investors worried. Another reason for this sudden switch in risk sentiment lies in comments by China’s banking and insurance regulator. During the Asian trading session, it expressed worries about existing bubbles in foreign markets. Now, China is researching the possibility of preventing turbulence in its market.

The gloomy outlook increased the demand for the US dollar. Notably, the USD advanced against the so-called “safe-haven” currencies: the Swiss franc and the Japanese yen.

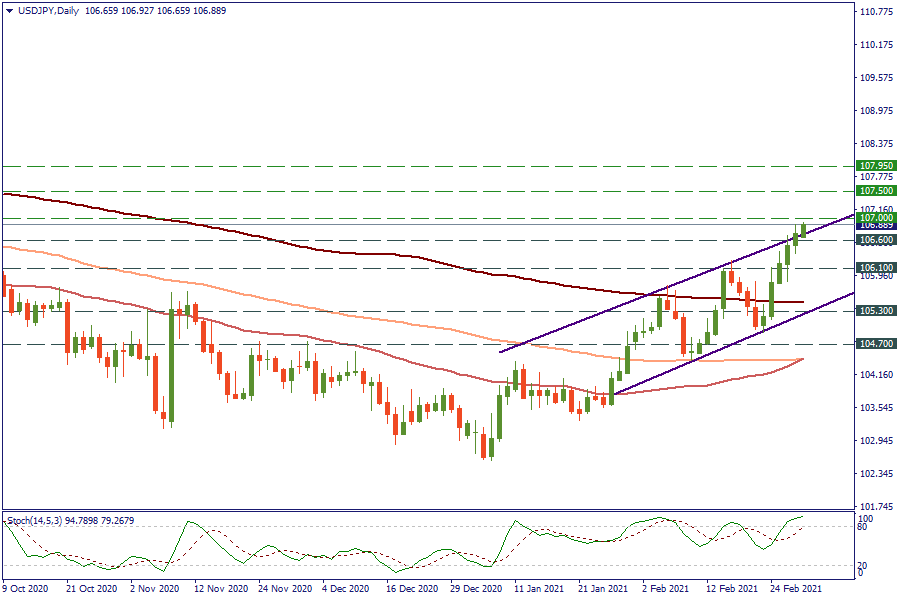

On the daily chart of USD/JPY, the pair has been trying to stick above the upper border of the ascending trading channel. The USD pushed the pair almost as high as 107. This is a very strong resistance marking the last August’s peak. On the downside, the closest support is placed at 106.6. The breakout of this level will provoke a further slide to 106.1. The signal line of the stochastic oscillator has almost entered the overbought zone. You may use the crossover of the stochastic oscillator’s two lines for an additional signal for shorts.

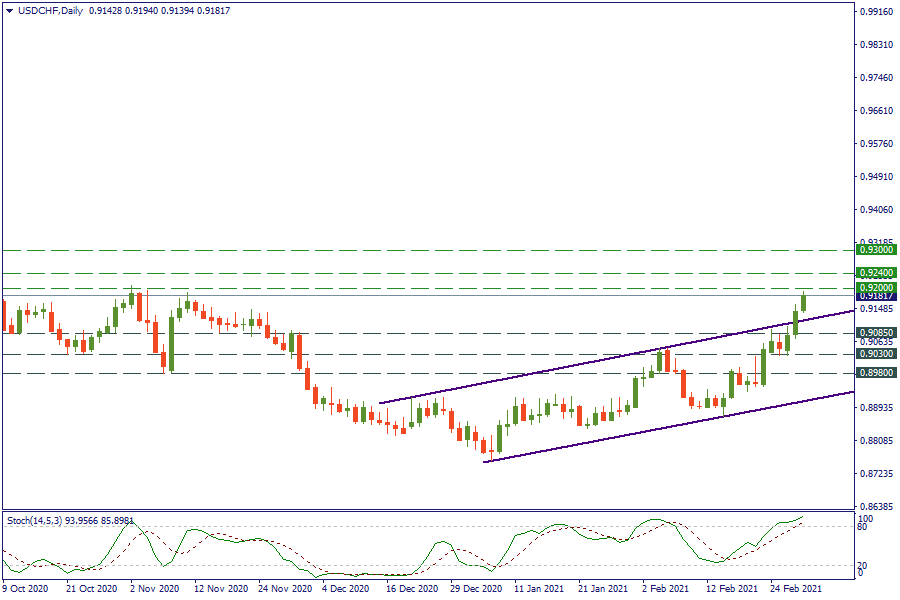

Unlike USD/JPY, USD/CHF has already left the trading channel and surged to a high of 0.92. The next resistance is placed at 0.9240. In case of correction, wait for the pair to reach the 0.9085 level. You can use the crossover of stochastic in the overbought zone (above 80) as a confirmation for a sell here as well.

If we talk about the future of both of these pairs, it mainly depends on the USD-related news. The closest major event for the US currency is the non-farm payrolls this Friday at 15:30 MT time. Thus, we may see some interesting swings in the performances of USD/JPY and USD/CHF.