Let's trade the hardshell Swiss franc

On Thursday, the Swiss National bank kept its interest rate unchanged at -0.75%, which is the lowest rate among the developed countries. The bank is interested in the negative level of its rate, as it protects the safe-haven Swiss franc from an unexpected rise during the times of crisis and global problems.

Also, in the monetary policy assessment by the SNB, it mentioned the fragile condition of the foreign exchange market as the main risk for the country and its currency. The Swiss national bank explains this statement as a reaction to global uncertainties, which include Brexit, protests in France and the Italian budget deficit. In addition, it lowered the inflation forecasts from 0.8% to 0.5% for 2019 and from 1.2% to 1.0% for 2020. As for GDP, the bank sees it slip to 1.5% in 2019 from 2.5% in 2018.

According to analysts, the cautious policy by the SNB, as well as the negatively revised economic forecasts mean that the rate hike can happen not earlier than in 2020. But do these dovish statements really mean anything for the strong franc?

Let's look at how the Swiss currency has been trading against the US Dollar, the British pound and the euro.

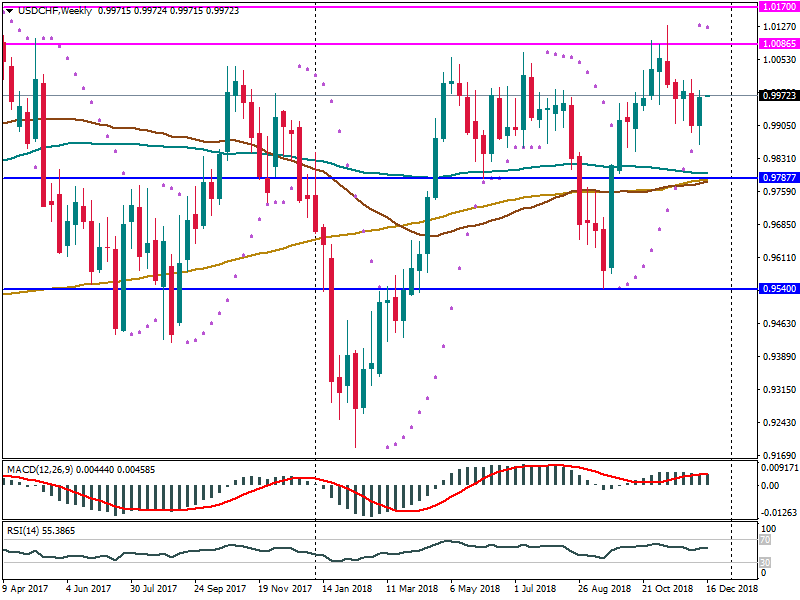

USD/CHF

The uptrend for the pair ended in the middle of November. The dovish comments from the Federal Open Market Committee members are one of the reasons behind this slide. However, the Parabolic SAR formed only one dot above the chart, which means it is too early to talk about the change of the trend. Both RSI and MACD do not signal the reversal. We need to pay attention to the FOMC statement this week on December 19 at 21:00 MT time, as the market expects a rate hike to 2.5%.

If the USD is supported by the FOMC statement, the pair will likely rise above its parity level. The first resistance lies at 1.0087. If bulls manage to break it, the next resistance is placed at 1.0170. If the Federal Reserve postpones the rate hike, it will disappoint the investors and traders. In case of the bearish pressure, the pair will fall to the support at 0.9788, which lies near the 100-, 50- and 200-week moving averages. The break of this support will pull the pair towards the next support at 0.9540.

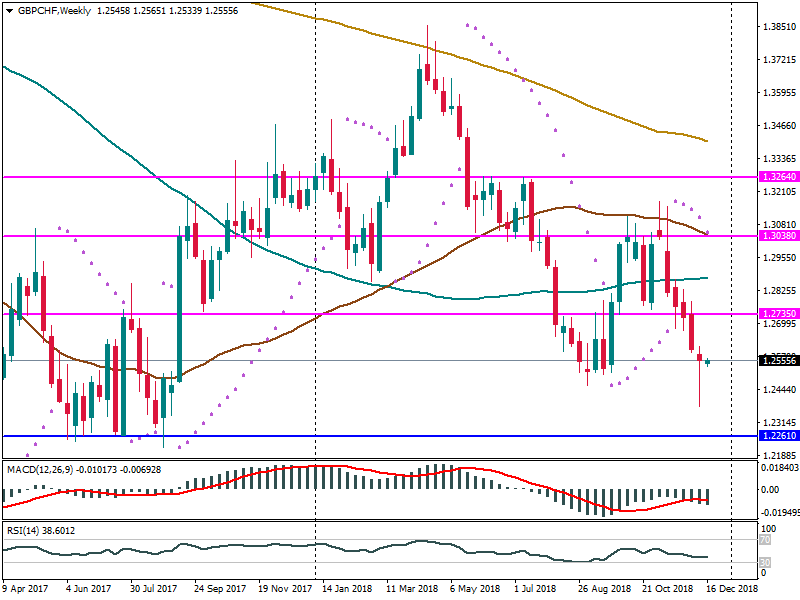

GBP/CHF

The British pound has been depreciating against the Swiss currency since November amid the Brexit uncertainties. If the Brexit agreement is not reached, the pair will move downwards to the support at 1.2261. If Theresa May protects the deal, it will rise towards the resistance at 1.2735. Besides the news on Brexit, we should keep an eye on the monetary policy summary by the Bank of England, which is scheduled for December 20 at 14:00 MT time. The hawkish comments by the BOE may also support the British pound.

From the technical side, the downtrend for the pair is still on, as the parabolic SAR signals downtrend. RSI and MACD show the currency pair will continue to go down.

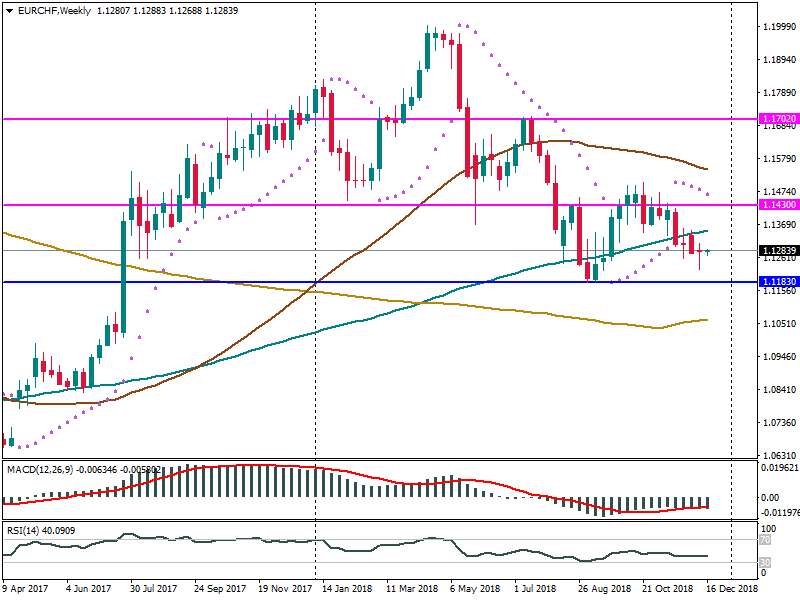

EUR/CHF

The pair moves down due to the weak EUR, which has been struggling with the Italian budget problem. The first support for EUR/CHF lies at 1.1183. If the EUR gains strength, it will go up to the resistance at 1.1430. RSI is placed in the middle, while MACD moves parallel to its signal line. Parabolic SAR formed 4 dots, which confirms the current downtrend.

Conclusion

Despite the dovish comments by the Swiss National Bank, the Swiss franc keeps being one of the strongest among the key currencies. The further direction for the USD/CHF, EUR/CHF and GBP/CHF pairs mainly depends on the conditions of the base currencies.