Saham-saham AS telah menunjukkan prestasi setengah tahun pertama yang terburuk dalam tempoh lebih 50 tahun kesan dari percubaan Fed untuk mengawal inflasi dan kebimbangan tentang kemelesetan.

2022-06-01 • Dikemaskini

China’s stock market performed well last week amid weakening lockdown measures. Traders are becoming bullish and greedy. Should we follow the crowd and buy HK50? This article will help you break it down.

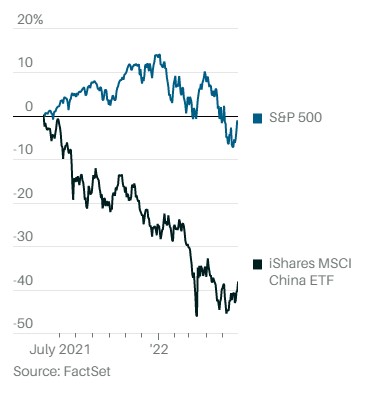

The iShares MSCI China (MCHI) index plunged year-to-date compared with the US stock market (US500 or S&P500). It had lost 25% over the last 12 months, and the US500 is only 2% down.

You need to know that the divergence between these indices is not a miracle or a random fluctuation. The US Federal Reserve printed trillions of dollars and injected them into the stock market. At the same time, China had many difficulties, starting from the Evergrande crash. One of the most prominent developers with over $340 billion worth of assets has been on the brink of collapse. Step by step, China saved the day, and Evergrande is still alive.

However, Covid-19 stroked again, putting the Chinese government in a precarious position. The “zero covid-19” policy made the country lock down its citizens, crashing the supply chains and shrinking production. The damage from those policies is in the billions of dollars. As for the start of Summer 2022, lockdowns are easing, and China is getting back to business. Is it the end of bad times?

A lot of the negatives are priced into share prices. Also, investors are paying insufficient attention to the potential of improving the Covid-19 situation and medium-to-long-term earnings growth prospects. The MSCI China Index is trading with low multiplicators. It signals about potential underestimation of the Chinese stock market.

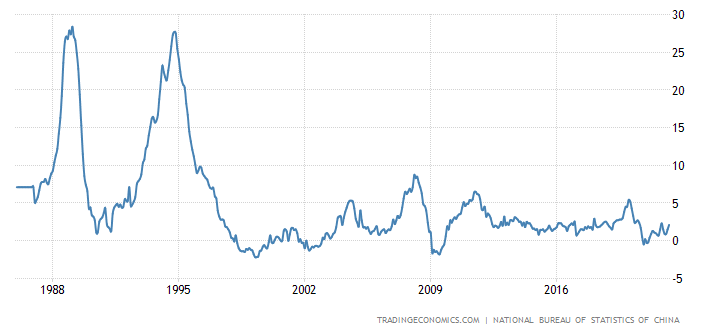

Moreover, inflation in China is at the bottom (it’s near an all-time low).

Once China gets rid of lockdowns and starts producing as much good as it did several years before, the HK50 is likely to soar with immense speed.

It will be a long way for HK50, but the expectations are worth them. On a macro scale, the index is near its 7-year low. Also, a bullish divergence occurred on the monthly chart. The consolidation may last for months or even a year, but we expect HK50 to skyrocket.

HK50 monthly chart

Resistance: 21.5K, 25K, 30K

Support: 20K, 18.5K

We see that HK50 is trying to move closer to the resistance trendline on the daily chart. As soon as the breakout happens, the uptrend will officially start.

HK50 daily chart

Resistance: 21.5K, 23K, 25K

Support:20K, 18.5K

Saham-saham AS telah menunjukkan prestasi setengah tahun pertama yang terburuk dalam tempoh lebih 50 tahun kesan dari percubaan Fed untuk mengawal inflasi dan kebimbangan tentang kemelesetan.

Menjelang bulan April, para pelabur sedang mencari peluang terbaik dalam pasaran saham. Terdapat dua industri yang berkembang pesat yang kelihatan positif untuk jangka masa terdekat; saham-saham kenderaan elektrik (EV) dan perbankan.

Apa yang akan terjadi? Walmart, sebuah syarikat peruncitan multinasional Amerika, akan membentangkan laporan perolehannya untuk suku keempat pada 17 Februari sebelum pasaran saham dibuka (16:30 GMT+2)…

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!