Pola carta segitiga (triangle chart patterns) ialah pola pengukuhan yang melibatkan harga aset yang bergerak dalam julat yang semakin mengecil.

2022-05-18 • Dikemaskini

Technical analysis is the base instrument for a trader. Although not all traders rely on technical indicators, we highly recommend combining different methods to get a higher profit.

So today we want to tell you how technical analysis appeared.

A “father” of the technical analysis is Charles Dow, who created the world famous Dow Jones Industrial Average Index together with Edward Jones. Moreover, he was a head editor in the Wall Street Journal where he was publishing his Technical Analysis from 1900 to 1902 as a series of articles. Later in 1932 Robert Rhea collected his works and published The Dow Theory.

Although technical analysis has developed, it is based on the Dow theory.

Let’s look at the basic tenets.

I. The price (average) discounts everything.

The main idea is that any factor that affects a price - economic, political, psychological - is already taken into consideration by a market and included in prices.

II. The market has three trends.

Firstly, it is worth to clarify what a “trend” is. Trend is the general direction of a market or a price. It can vary in length from short to intermediate, to long term.

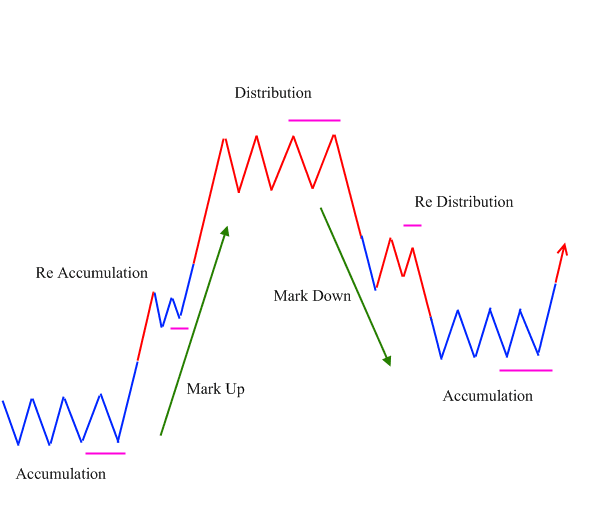

III. The market trends have three phases.

They are:

IV. Volume must confirm the trend.

Dow assumed that volume should increase in the direction of the main trend. So while upward trend, the volume should grow with an increase in price. Vice versa, in major downward trend, volume should expand together with falling prices.

V. A trend is assumed to be in effect until it gives a definite signal of reversal.

Dow believed that trend remains until the specific signal of reversal appears.

The logic is: an upward trend is created when every next pick and dip are higher than previous ones. A downtrend, on the contrary, has decreasing peaks and dips. So an obvious signal for the upcoming reversal is the formation of a lower minimum within the upward movement. In the case of the downward trend, the situation is reversed.

There are other reversal signals such as resistance/support, price patterns, trend lines and moving averages.

Making a conclusion, we can say that although nowadays technical analysis and markets have developed, the Dow theory had a huge influence on them. Also, the idea of emotions in the marketplace still remains a characteristic of market trends. Furthermore, its aspects were incorporated into other theories, such as Elliott Wave theory. So we can say that the Dow theory played an enormous role in the trading theory.

Pola carta segitiga (triangle chart patterns) ialah pola pengukuhan yang melibatkan harga aset yang bergerak dalam julat yang semakin mengecil.

Ada kalanya carta atau pola candlestick boleh memberikan signal masuk yang baik jika ia terletak pada aras tertentu. Pin Bar salah satu pola candlestick yang paling andal dan terkenal, dan apabila pedagang menemuinya di carta, mereka menjangkakan harga akan berubah arah tidak lama lagi.

Terdapat banyak strategi berharga yang memerlukan pengetahuan tentang pola candlestick dan osilator. Walau bagaimanapun, bukan semua strategi tersebut menguntungkan. Apabila anda mula berdagang dengannya, anda boleh berhadapan dengan situasi di mana strategi tidak berfungsi mengikut jangkaan anda.

Jika anda berumur 18+, anda boleh sertai FBS dan mulakan kembara FX anda. Untuk berdagang, anda perlukan sebuah akaun perbrokeran dan ilmu yang mencukupi tentang tindak-tanduk aset di pasaran kewangan. Mulakan dengan mempelajari ilmu-ilmu asas menerusi bahan-bahan pengajian percuma kami dan buka akaun di FBS. Mungkin anda mahu mencuba suasana perdagangan dengan wang maya di akaun Demo terlebih dahulu. Apabila anda sudah bersedia, masuk ke pasaran sebenar dan berdagang untuk berjaya.

Klik butang 'Buka akaun' di laman web kami dan teruskan ke Laman Pedagang. Sebelum anda boleh mula berdagang, lengkapkan pengesahan profil. Sahkan emel, nombor telefon, dan ID anda. Prosedur ini menjamin keselamatan dana dan identiti anda. Setelah proses pengesahan lengkap dan lulus, pergi ke platform perdagangan pilihan anda, dan mula berdagang.

Prosedurnya sangat mudah. Pergi ke halaman Pengeluaran di laman web atau seksyen Kewangan dalam Laman Pedagang FBS dan buat pengeluaran. Anda boleh mendapatkan wang yang diraih menerusi sistem bayaran yang sama yang anda gunakan untuk deposit. Sekiranya anda memasukkan dana ke dalam akaun menerusi pelbagai kaedah, keluarkan keuntungan anda dengan kaedah-kaedah yang sama dalam nisbah yang sama.

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!