Ketahui mengapa FBS mengurangkan spread GBPCAD dan apa yang perlu dilakukan seterusnya!

2022-05-26 • Dikemaskini

Inflation (= meaning the generalized and continuous increase of prices in an economy) is a very important economic phenomenon, affecting practically all investments in financial assets in the capital market. Therefore, for investors and traders alike it is highly recommended to understand the dynamics of inflation and some of its causes. One of the causes that influences inflation is the level of economic activity. When an economy is heated, with very low unemployment and a sufficient demand pressure, prices tend to accelerate, causing inflation. This also occurs due to pressure for wage increases in the labor market, which causes companies to transfer these costs to the prices of their products and services. This increase in wages and prices, if strong, can therefore cause inflation.

A second cause of inflation can be exchange rate devaluation. With exchange/currency devaluation, imports become more expensive, and this can lead to an increase in prices in the domestic market for products that depend precisely on imports from abroad, reflecting on the entire economy. With exchange appreciation, in turn, inflation tends to fall. A third cause of inflation is considered to be supply shocks, representing an increase in the prices of important inputs (such as commodities), which tend to affect the entire economy as well, such as gasoline and petroleum-derived fuels. In any case, what are the main indicators of inflation in an economy? Usually these indicators involve the so-called 'consumer price indexes' which are collected by the statistics departments of each country.

In the FBS economic calendar, our traders can find some important indicators regarding inflation:

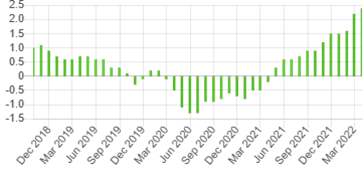

We see for example that the increase in the Swiss inflation rate between April 2021 (0.3%) and March 2022 (2.4%) appeared to have been (in part) a reflection of the devaluation of the franc (CHF) against its international peers, mainly the USD. In the chart below, we see the appreciation of the USD against the CHF in the period indicated.

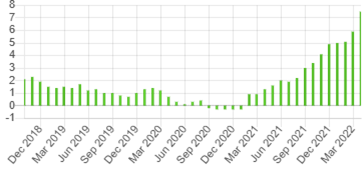

We see for example that the increase in the Eurozone inflation rate between January 2021 (0.9%) and March 2022 (7.5%) appeared to have been (in part) a reflection of the devaluation of the Euro (USD) against its international peers, especially the USD. In the chart below we see the devaluation of the EUR against the USD in the period indicated.

Ketahui mengapa FBS mengurangkan spread GBPCAD dan apa yang perlu dilakukan seterusnya!

Kenaikan hara yang berlaku itu adalah sebelum mesyuarat FOMC di mana harga berjaya capai ketinggian 1…

Minggu hadapan akan sarat dengan pelbagai berita. Penggunaan di Amerika Syarikat dan Kanada, pasaran hartanah di Amerika Syarikat, dan inflasi di EU. Apa yang perlu dijangkakan, dan bagaimana ini akan mempengaruhi pasaran?

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!