Kenaikan hara yang berlaku itu adalah sebelum mesyuarat FOMC di mana harga berjaya capai ketinggian 1…

2022-12-15 • Dikemaskini

China may respond to US House Speaker Nancy Pelosi's visit to Taiwan with military provocations, including firing missiles near Taiwan or large-scale air or naval activities. Taiwanese and US media say Pelosi plans to visit Taipei on Tuesday night, but there’s no official confirmation. However, responding to reporter questions on Tuesday, Taiwan's Premier Su Tseng-chang said the island "warmly welcomes" any foreign guests. He added that Taiwan "would make the most appropriate arrangements" for visitors.

China's leader Xi Jinping believes in the correctness of the principle of a "united China." According to his beliefs, Taiwan historically belonged to China, so it must be returned in any way.

However, it’s not the only reason. Taiwan's electronics sector attracts the most significant share of foreign investment. Indeed, Taiwan's significance to the global semiconductor industry cannot be understated. Taiwan Semiconductor Manufacturing Company (TSMC) is the world's largest contract chip manufacturer and Asia's most valuable listed company at $600 billion. Much of the world's global semiconductor supply chain relies on Taiwan.

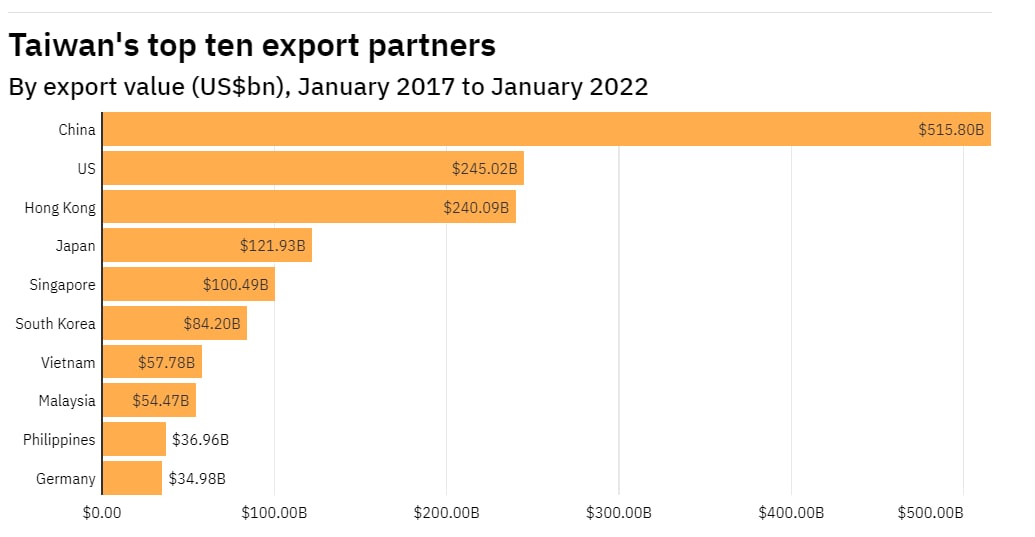

Taiwanese exports across the strait to mainland China were at an all-time high in 2021, but perhaps more importantly, the small island nation has China in a chokehold over semiconductors. In 2020, China spent more on importing chips than it did oil (many experts believe China is stockpiling chips).

There’s a risk that any Chinese invasion of Taiwan would damage or destroy much of the tech infrastructure China relies on to feed its electronics and manufacturing industries with crucial components. The invasion might make Taiwan's semiconductor industry the spoils of war, but, equally, the Taiwanese might be ready to destroy semiconductor plants themselves, most notably TSMC's network of advanced factories, to deprive the Chinese of some of those spoils.

Moreover, it’s questionable whether the Chinese could operate the fabs without the cooperation of the world-beating TSMC team of managers, researchers, and engineers, at least for a few years.

XAUUSD, weekly

Gold will break above $1785 and fly towards $1830 on escalation.

US dollar, daily

US dollar bounced off the local support of 105.00, and the uptrend is still valid. Any escalation will push the greenback’s index to 110.00, pressing other currencies down versus the USD.

Do you want to get updates Live? Subscribe to the @FBSAnalytics Telegram Channel where I post more daily trade ideas!

Kenaikan hara yang berlaku itu adalah sebelum mesyuarat FOMC di mana harga berjaya capai ketinggian 1…

Pengaruh dolar sebagai matawang rizab dunia telah merosot secara beransur-ansur. Adakah mungkin untuk euro menggantikannya? Kami juga tidak pasti tentang perkara itu.

Fundamental : …

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!