Gas asli adalah tiang seri ekonomi Eropah.

2019-11-11 • Dikemaskini

On Thursday, July 26, the European Central Bank will hold a meeting. As usual, the Central Bank will release the interest rate and conduct the press conference. Should we expect something exciting from the meeting?

Of course, the market doesn’t expect any changes in the interest rate. To raise the interest rate, the ECB hasn’t tapered the quantitative easing program yet. On the June meeting, the ECB announced that it will taper the QE by the end of 2018. Moreover, the Bank warned that the rate hike will be kept on hold “at least through the summer of 2019”. To cut the interest rate, the Central Bank doesn’t have any reasons as the economic data are stable. Furthermore, the interest rate at record lows, the further cut doesn’t seem sane. If no interest rate changes, what should we listen to?

The speech of Mr. Draghi is something to look at. The President of the Central Bank may give some clues on the future monetary policy. If he sounds hawkish about current economic conditions, the euro will appreciate. If Mr. Draghi sounds dovish or just neutral, the euro will go down.

The June meeting was too eventful. Let’s remember that last time the ECB announced dates of the end of QE, approximate date of a rate change and future reinvestments of maturing securities of its QE portfolio. As a result, there are risks that the July meeting will be boring for the market.

We have gathered forecasts of the authoritative financial institutions for the ECB announcement.

BNP Paribas doesn’t expect any changes in the July speech. Despite the improvement of the economic data, the Central Bank isn’t anticipated to be more hawkish as the escalation of trade wars tensions weighs on the ECB’s sentiment. Moreover, Mr. Draghi may turn down questions on the future rate moves.

Barclays doesn’t anticipate the Central Bank to give any new information too. However, the bank waits for interesting comments on recent developments in the economic data and trade wars tensions.

UBS is sure that the July meeting won’t be able to beat the June meeting with the number of announcements. Moreover, the bank considers a possibility that the Central Bank may sound more skeptical about the economic outlook. However, it anticipates a clarification on the date of the rate hike. Last time the ECB statement was quite uncertain providing the market with “through the summer of 2019”. As a result, the market keeps arguing whether the rate hike will happen in the summer of 2019 or September 2019. Also, the ECB may provide details of the reinvestment policy.

Looking at the forecasts, we can sum up that the ECB is not anticipated to be more hawkish than it was last time. Despite the development in the economic data, trade wars tensions may make the Central Bank more cautious. However, the market wants to hear more details on the last ECB’s announcements.

If the Central Bank’s statement satisfies the market’s expectations, the euro will go up. If the Central Bank sounds cautious with no clear details on the market’s questions, the euro will suffer.

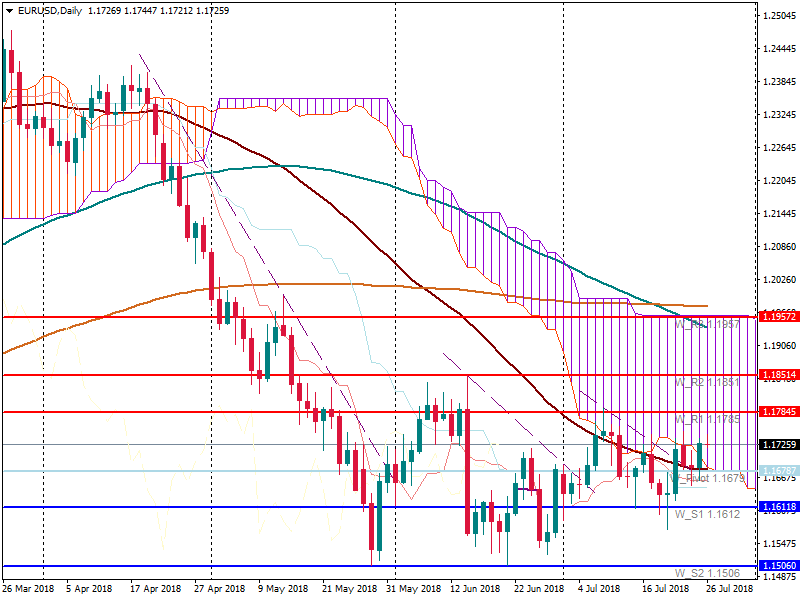

Let’s take a closer look at the technical side.

From the beginning of the week, EUR/USD has been trying to stick above 1.1680 (the pivot point, 50-day MA). The ECB statement will determine the direction of the pair. If the Central Bank is hawkish, the pair will gain a foothold above the pivot point and will move to 1.1785. The Ichimoku cloud signals the narrowing depreciation. However, if the market is not happy with the statement, the pair will fall below 1.1680.

Gas asli adalah tiang seri ekonomi Eropah.

Selepas beberapa bulan menerima tekanan dari Rumah Putih, Arab Saudi mengalah dan bersetuju untuk meningkatkan pengeluaran bersama dengan ahli-ahli OPEC+ yang lain.

Ya, harga minyak sedang terbakar menyala-nyala sekarang, dan, akibatnya, inflasi semakin memanas di seluruh dunia. Namun begitu, momentum kenaikan harga minyak sedang terancam.

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!