Gas asli adalah tiang seri ekonomi Eropah.

2021-04-29 • Dikemaskini

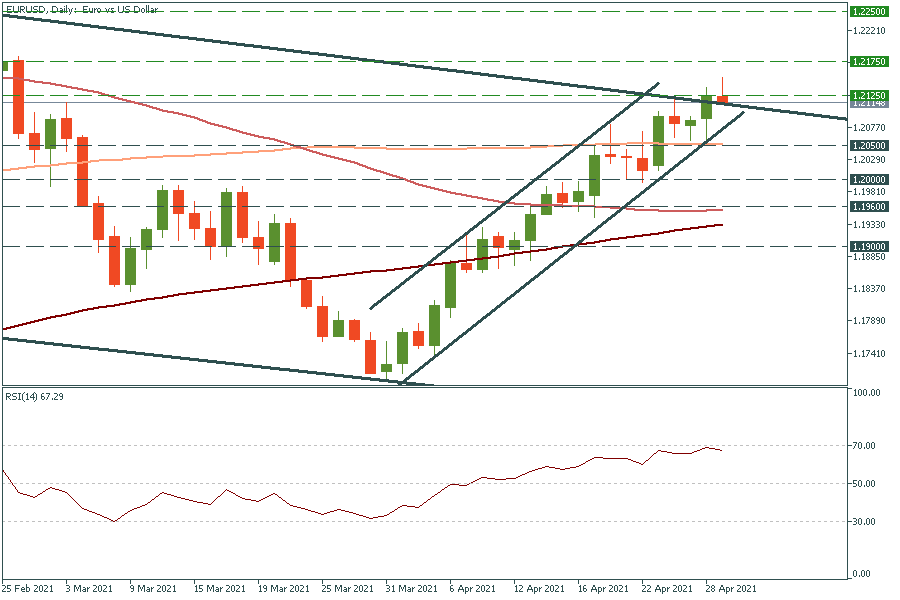

The Federal Reserve left the policy unchanged yesterday and signaled that it wouldn’t be ready to tighten the policy anytime soon. After that meeting, the USD dropped and EUR/USD rocketed to the two-months high.

Today, the pair has already reversed down as the demand for the greenback resurged. Fresh worries over the increase in coronavirus cases in India are worsening the market sentiment and therefore supporting the safe-haven US dollar.

Besides, the USA will publish its Advance GDP growth at 15:30 MT (GMT+3), which is widely expected to beat forecasts. If the data is really stronger-than-expected, the USD will get another stimulus to rise and EUR/USD will fall. Nevertheless, in the long term, EUR/USD is likely to move higher as the focus will shift to the European economic recovery.

According to Westpac, “EUR/USD looks set to remain in the upper half of its 1.17-1.22 range, but is likely to struggle towards range resistance.”

In the long term, EUR/USD is moving in a downtrend, while in the short term, it’s trending up. After breaking the upper trend line, the pair reversed down as the RSI indicator came closer to 70.00, signaling the pair is overbought. It may fall to the 100-day moving average of 1.2050, but it’s unlikely to break this level on the first try as it’s strong support, which the pair has failed to cross several times. So, this decline should be just a correction ahead of the further rally up. If it bounces off the 1.2050 mark, on the way up it will meet resistance levels at yesterday’s high of 1.2125 and the high of February 25 at 1.2175.

Gas asli adalah tiang seri ekonomi Eropah.

Dua tahun ini, kita menyaksikan pergerakan harga minyak terbesar dalam tempoh 14 tahun, yang membingungkan pasaran, pelabur dan pedagang akibat ketegangan geopolitik dan peralihan ke tenaga bersih.

Selepas beberapa bulan menerima tekanan dari Rumah Putih, Arab Saudi mengalah dan bersetuju untuk meningkatkan pengeluaran bersama dengan ahli-ahli OPEC+ yang lain.

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!