Coinbase (#COIN) menyaksikan hasilnya meningkat kepada $773 juta pada Q1 2024, peningkatan 23% daripada suku sebelumnya dan melepasi jangkaan penganalisis.

2023-12-06 • Dikemaskini

As the year winds down and the festive spirit takes hold, the stock market often presents a curious yet anticipated phenomenon known as the Santa Rally. Characterized by a general uptick in stock prices from late December into the early days of January, this period is marked by a blend of investor optimism, holiday-induced spending, and strategic financial moves influenced by tax considerations. Within this whirlwind of festive trading, let’s look at how two titans of the tech world, Amazon and Apple, might fare during this unique season.

Amazon, a dominant force in global retail, strategically positions itself at the epicenter of the holiday shopping season. This period typically witnessed a significant escalation in consumer spending, which invariably led to a robust increase in Amazon's fourth-quarter revenues. This seasonal uptick is more than a mere festive phenomenon; it directly influences Amazon's stock performance, potentially leading to a notable upswing in its market valuation. But now is the time if you've been thinking about a potential entry point for a long time.

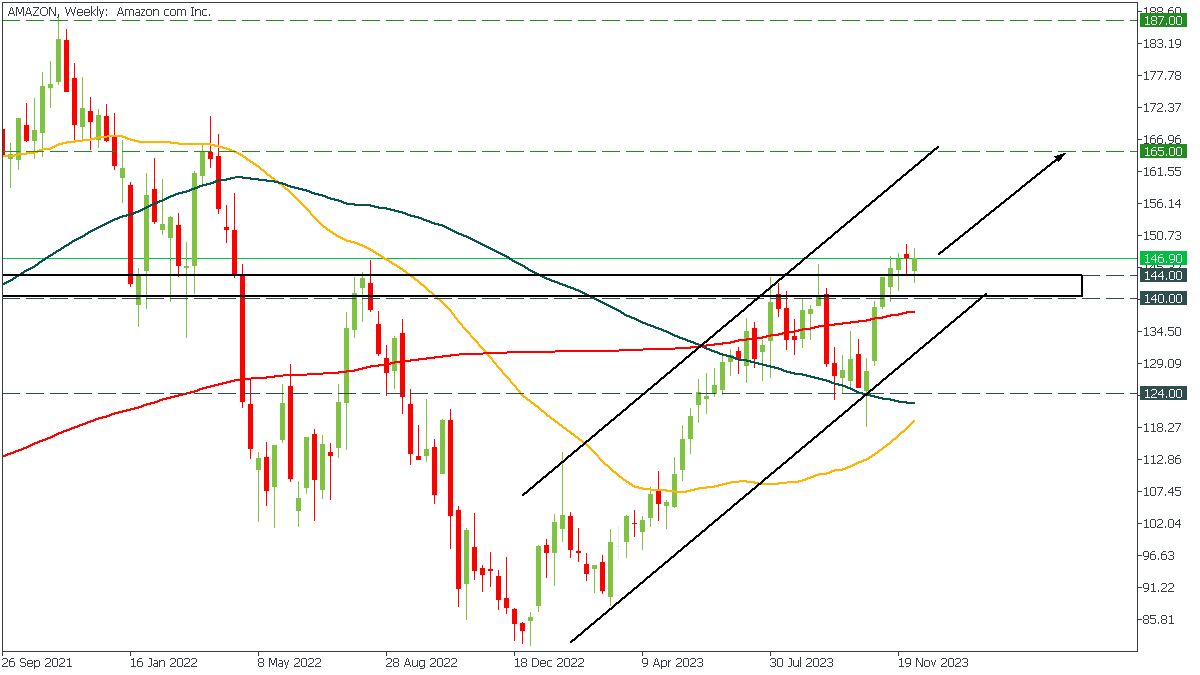

The price is moving inside the ascending channel. Moreover, the stock broke above the 140.00 - 144.00 area. As long as Amazon trades above the lower channel’s border and the highlighted zone, traders should consider buying with the target of 165.00.

Reflecting on Amazon's trajectory in 2023, it is evident that the company has exceeded market expectations, demonstrating remarkable growth and innovation. Nevertheless, as the Santa Rally approaches, certain challenges overshadow this optimism. Notably, AWS, previously a cornerstone of Amazon's growth, shows signs of deceleration.

Therefore, if the price loses the 140.00 - 144.00 support range and the lower channels border, the stock will decline to 124.00.

Then there's Apple, whose products often top holiday wish lists. Apple’s consistent revenue flow, powered significantly by its iPhone and Services segments, lays a strong foundation for its Santa Rally prospects.

With its ever-growing high-margin service revenues and commitment to research and development, Apple has improved its business model and boosted equity returns to impressive heights. These factors and a robust pre-tax return on equity paint a picture of a company in robust financial health – a beacon for traders during the Santa Rally.

Apple's stock price has been steadily rising inside the ascending channel. Currently, the price is approaching an all-time high of 198.00. A successful breakout of this resistance will open the way to 218.00, the 161.8 Fibonacci level.

The Santa Rally presents a promising horizon for both Amazon and Apple, as their robust market presence and strategic strengths align well with the festive season's upbeat sentiment. This period offers traders a unique opportunity to capitalize on the optimistic trends and potential growth these tech giants bring.

Coinbase (#COIN) menyaksikan hasilnya meningkat kepada $773 juta pada Q1 2024, peningkatan 23% daripada suku sebelumnya dan melepasi jangkaan penganalisis.

Saham-saham FAANG mula pulih. Mana satu yang terbaik menurut analisis fundamental?

Saham-saham AS telah menunjukkan prestasi setengah tahun pertama yang terburuk dalam tempoh lebih 50 tahun kesan dari percubaan Fed untuk mengawal inflasi dan kebimbangan tentang kemelesetan.

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!