Gas asli adalah tiang seri ekonomi Eropah.

2023-06-01 • Dikemaskini

Thanks to the incredible advancements in horizontal drilling and fracking technology, the United States has experienced a mind-blowing shale revolution. They've become the heavyweight champion of crude oil production, leaving Saudi Arabia and Russia in the dust. They even turned the tables and became net exporters of refined petroleum products in 2011. Talk about a plot twist! This seismic shift has made the U.S. about 90% self-sufficient in energy consumption, according to the Energy Information Administration. As U.S. oil exports soar, oil imports take a nosedive, which not only helps decrease the trade deficit but also throws the historically strong relationship between oil prices and the U.S. dollar off balance. Buckle up, folks! The oil market is full of surprises. Happy trading!

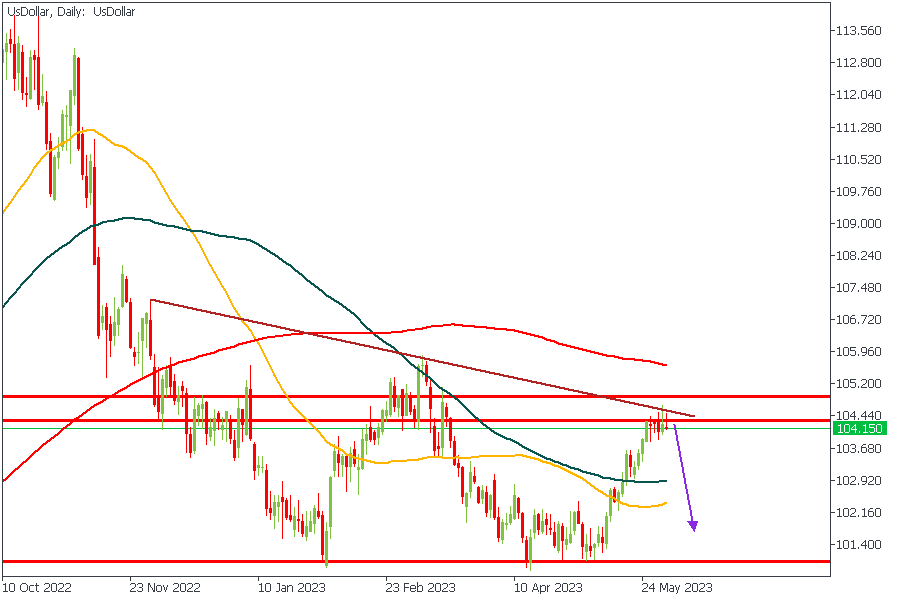

The US Dollar on the daily timeframe has finally given the first signs of a rejection from the supply zone as highlighted above. The additional confluence from the resistance trendline and the descending array of the moving averages seems to lend even more credence to the possibility of a bearish price action on the US Dollar chart.

Analyst’s Expectations:

Direction: Bearish

Target: 102.75

Invalidation: 104.71

As I earlier explained in the first paragraph, the relationship between the value of the Dollar and the price of Oil has seen some drastic changes in recent times. This indicates the possibility of a positive correlation between both commodities. Based on the price action of US Crude trading within the descending channel, and the bearish array of the moving averages, I believe we should get to see XTIUSD drop even further.

Analyst’s Expectations:

Direction: Bearish

Target: 63.28

Invalidation: 74.49

Brent may yet continue on its bearish rally due to the confluence of the descending channel and the bearish moving average array. The latest rejection on XBRUSD also seems to have happened from the 50-Day average. I, therefore, expect to see a continued bearish price action until the trendline support is reached.

Analyst’s Expectations:

Direction: Bearish

Target: 66.73

Invalidation: 78.43

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.

Gas asli adalah tiang seri ekonomi Eropah.

Dua tahun ini, kita menyaksikan pergerakan harga minyak terbesar dalam tempoh 14 tahun, yang membingungkan pasaran, pelabur dan pedagang akibat ketegangan geopolitik dan peralihan ke tenaga bersih.

Selepas beberapa bulan menerima tekanan dari Rumah Putih, Arab Saudi mengalah dan bersetuju untuk meningkatkan pengeluaran bersama dengan ahli-ahli OPEC+ yang lain.

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!