Pada 4 Mei, Rizab Persekutuan AS mendedahkan kadar dana persekutuan untuk dua bulan yang akan datang. Walaupun kenaikan 50 mata asas itu sudah dijangka secara meluas, masa depan masih tidak begitu jelas.

2024-02-23 • Dikemaskini

On Friday, the gold price (XAUUSD) retreated from a recent two-week high, facing selling pressure. This decline was driven by hawkish minutes from the FOMC meeting, indicating the Fed's reluctance to cut interest rates. Elevated US Treasury bond yields, supported by a "higher-for-longer" narrative, further weakened demand for gold, as investors favored yield-bearing assets. However, the US dollar struggled to gain momentum, staying near three-week lows, potentially supporting gold as a safe-haven asset amid geopolitical tensions in the Middle East. Moving forward, market attention will focus on US bond yields and USD dynamics, with short-term opportunities in XAUUSD influenced by broader risk sentiment.

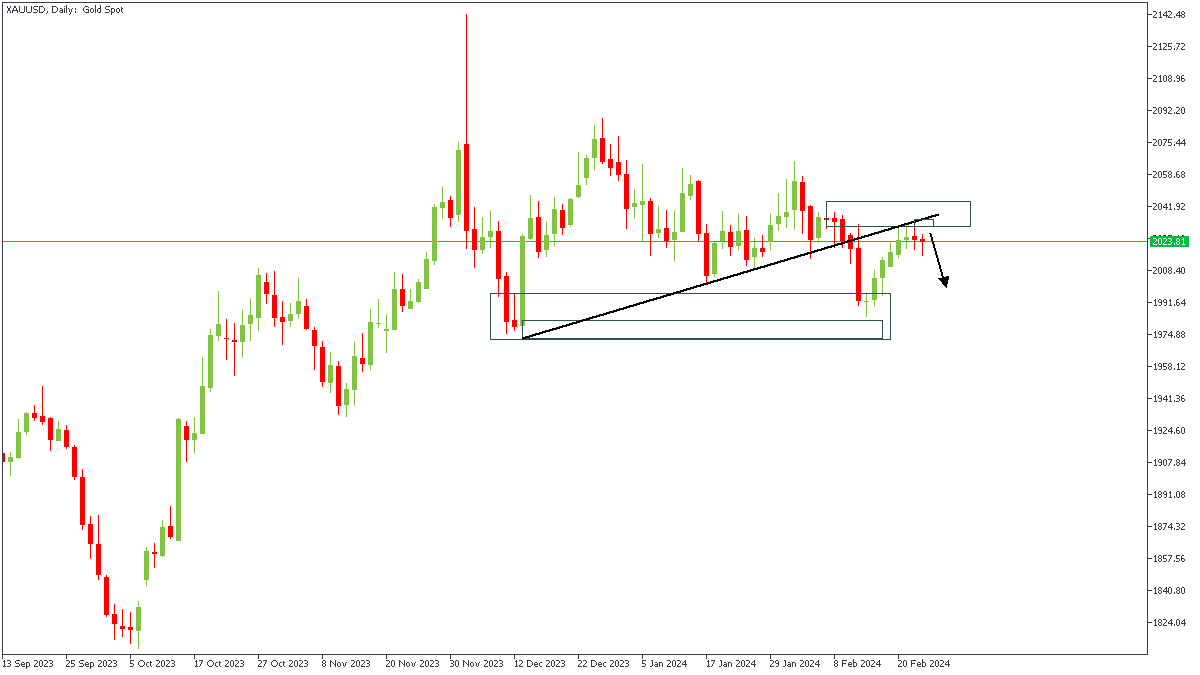

Price action on the daily timeframe of XAUUSD shows price currently reacting from the rally-base-drop supply zone, albeit in a subtle manner. We also see that the previous low has been broken, which means that price can be said to have completed the retracement. The added confluence to this is the trendline resistance that price seems to also be reacting to at this time.

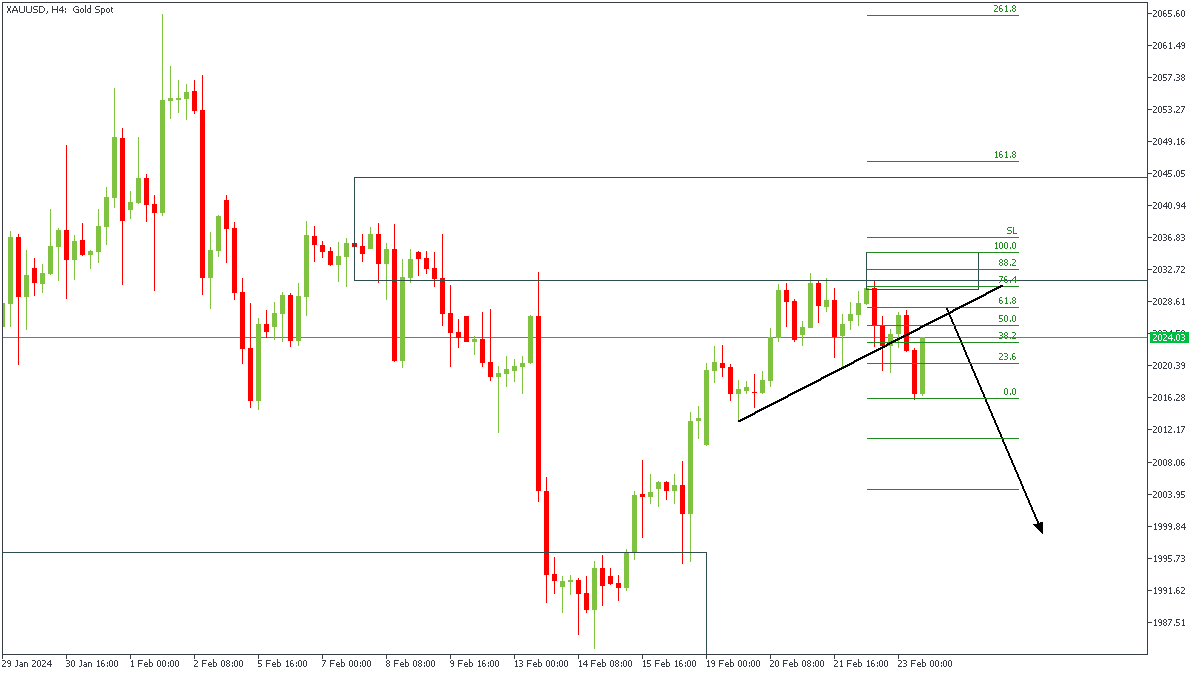

After reacting from the supply zone on the daily timeframe, here on the 4-hour chart of XAUUSD, we see that a change of character has already occurred from the recent break of structure. Following this, I expect to see a proper rejection from the trendline resistance and the Fibonacci retracement level. My target for this idea is the previous demand zone as shown on the chart.

Analyst’s Expectations:

Direction: Bearish

Target: $2,004.62

Invalidation: $2,044.96

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.

Pada 4 Mei, Rizab Persekutuan AS mendedahkan kadar dana persekutuan untuk dua bulan yang akan datang. Walaupun kenaikan 50 mata asas itu sudah dijangka secara meluas, masa depan masih tidak begitu jelas.

Selain daripada tekanan inflasi, semua faktor lain bertindak sebagai penghalang kepada emas selepas mencapai paras $2000 pada bulan Ogos 2020. Tetapi inflasi bersama dengan kelembapan ekonomi global adalah faktor yang menjadikan emas bersinar dengan lebih cerah.

Biasanya, harga emas didorong oleh ketidaktentuan politik dan ekonomi, seperti krisis ekonomi, tekanan pilihanraya,

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!