Ketahui mengapa FBS mengurangkan spread GBPCAD dan apa yang perlu dilakukan seterusnya!

2024-03-18 • Dikemaskini

The Reserve Bank of Australia (RBA) is widely anticipated to maintain its current interest rates at 4.35% following its two-day meeting concluding on Tuesday. Despite holding rates steady since December, the RBA has hinted at the possibility of further rate hikes due to persistently high inflation, which has exceeded its target range of 2% to 3%. During its February meeting, some RBA members advocated for a 25 basis points increase in interest rates. While the RBA is not expected to raise rates in March, it is likely to maintain a hawkish stance due to concerns about inflation. Analysts predict that the RBA may wait until inflation moderates within its target range, which they expect to occur in the September quarter of 2024. However, the RBA's hawkishness may be constrained by a cooling Australian economy, as evidenced by sluggish GDP growth in the December quarter.

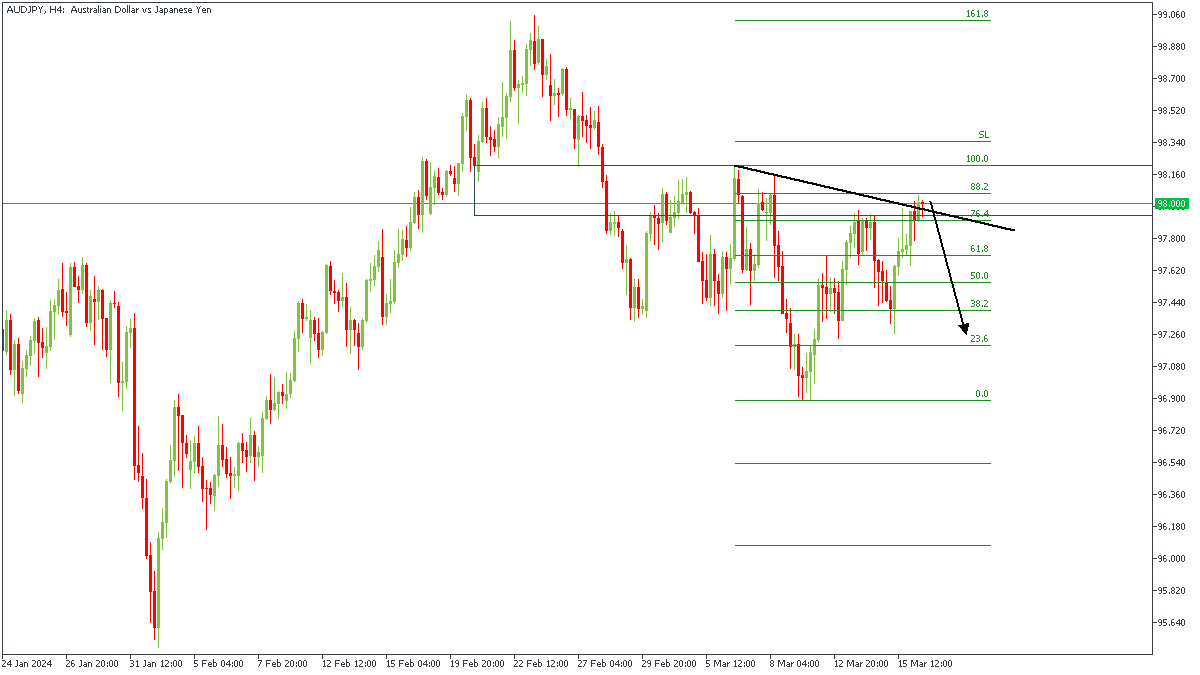

At the moment, on the H4 timeframe of AUDJPY, we see price currently riding into the trendline resistance and the 88% Fibonacci retracement level. Also, there is a pivot zone from the daily timeframe being respected by the current price action - which leads me to expect a bearish impulse from the aftermath of the rates decision.

Analyst’s Expectations:

Direction: Bearish

Target: 97.215

Invalidation: 98.231

On the Daily timeframe of AUDNZD, we can see price approaching the 88% of the Fibonacci retracement level, as well as the trendline resistance. The market structure also appears clearly bearish. All of these factors point to a possible bearish impulse following the rate statement release.

Analyst’s Expectations:

Direction: Bearish

Target: 1.06373

Invalidation: 1.08365

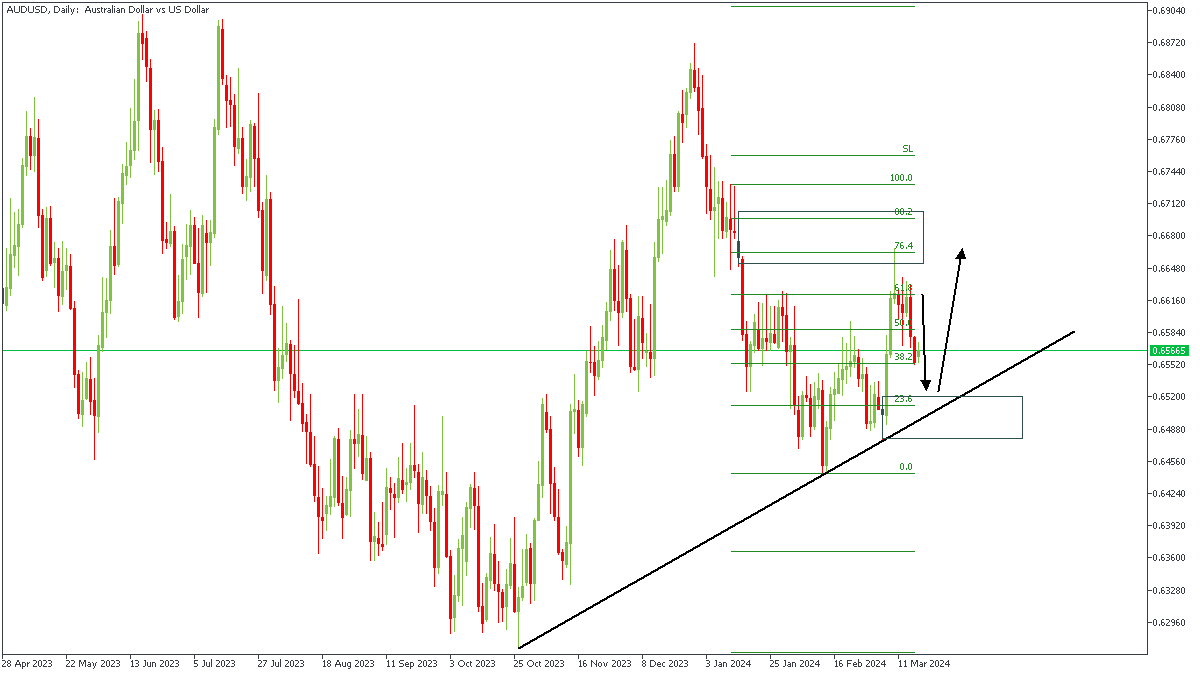

In line with the analysis last week, we’ve seen good movement from the bearish momentum on AUDUSD, but I believe we may see a change in the market direction shortly. From the chart we can see the price action currently approaching the trendline support and the demand zone. The outcome of the RBA’s rate statement could provide just the right motivation to turn the direction of the market around.

Analyst’s Expectations:

Direction: Bullish

Target: 0.66611

Invalidation: 0.64779

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.

Ketahui mengapa FBS mengurangkan spread GBPCAD dan apa yang perlu dilakukan seterusnya!

Kenaikan hara yang berlaku itu adalah sebelum mesyuarat FOMC di mana harga berjaya capai ketinggian 1…

Pengaruh dolar sebagai matawang rizab dunia telah merosot secara beransur-ansur. Adakah mungkin untuk euro menggantikannya? Kami juga tidak pasti tentang perkara itu.

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!